[AI generated image]

The 2024 global election calendar is packed. Starting with Taiwan in January and running through the US presidential election in November, the year will bring 40 national elections. Voters in countries representing 41% of the world’s population have a chance to elect new leaders next year[i].

The future is always unknowable but next year is especially uncertain. Regardless of how votes turn out, here are 10 trends to watch in 2024.

LISTEN TO ARTICLE

1. Exponential technological progress

Accelerating technological progress makes our era the most important in the history of mankind. The rapid change will also cause many social problems. Specifically, advances in Synthetic Biology, Artificial Intelligence, and Quantum Computing will accelerate in 2024.

2. Two out of the three major economies in the world are sick, will the US economy remain healthy?

Two of the three major economies of the world are in trouble. China is in the midst of a major housing downturn and Europe is reeling from the loss of cheap Russian natural gas. The third major economy, the US, remains strong but will go the way of the consumer. Forecasts are mixed, but in general, predict moderate growth. We believe the future is unknowable, but we’ll be watching the US consumer closely for signs of strain, like rising credit card delinquencies, declining “revenge spending” (e.g. cruises), and the impact of remote work on the real estate market.

We included a quote from investor Ray Dalio in last year’s yearly preview, and will do so again. It captures the multi-decade cycle we believe the economy has entered.

…a much bigger paradigm shift is under way than a simple rise in interest rates and inflation. He cites the risks of huge debts, populism within Western democracies and rising tensions between global powers. The first puts pressure on central banks to tolerate inflation and even monetise debt rather than raising rates. The second and the third could spur conflict both within and between states. Mr Dalio worries that the stage could be set for a period like that between 1910 and 1945, where in some regions “you have almost the complete destruction of wealth as we know it”.[ii]

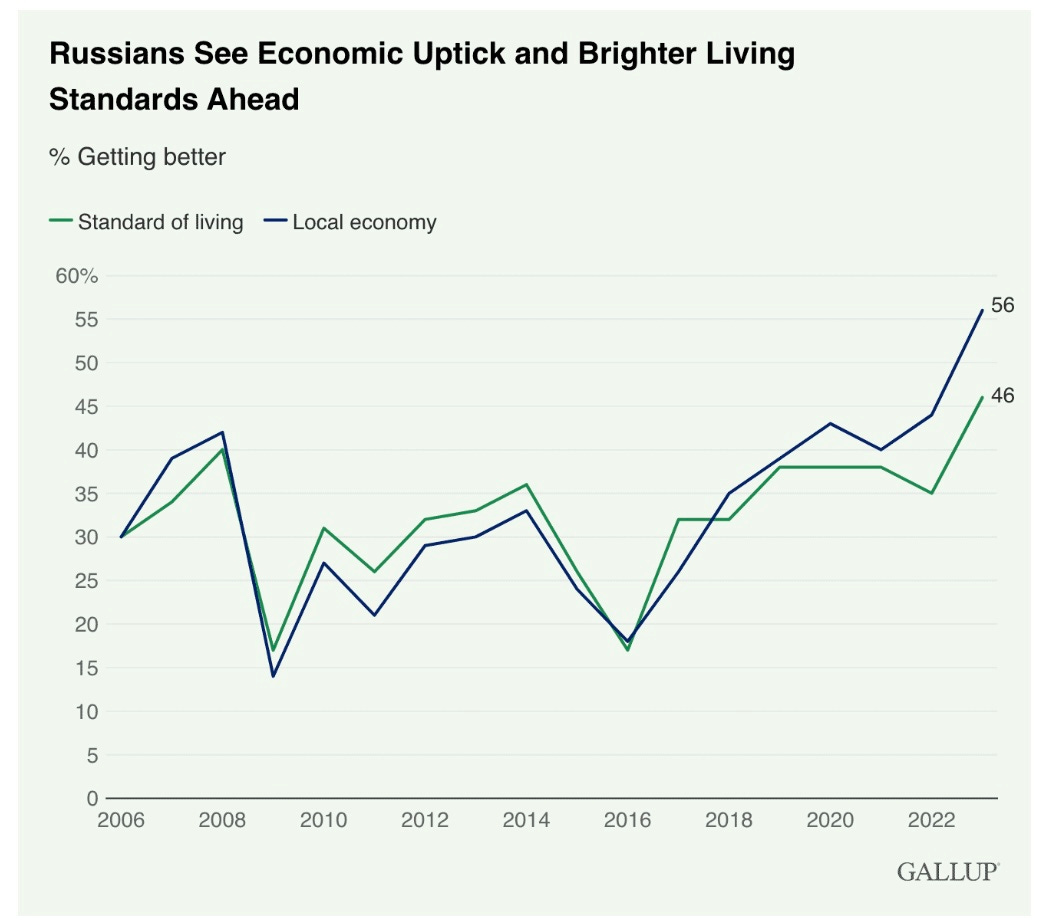

3. The Russian economy is overcoming sanctions

The West applied massive economic sanctions to Russia after its invasion of Ukraine. But Russia’s trading partners in Europe were replaced by partners in China, India, and elsewhere in the Global South. The sanctions, meant to cripple and isolate Russia, have not been effective. Expect that trend to continue in 2024.

4. Ukraine is losing

The human toll in Ukraine has been horrendous. US intelligence estimates there have been 190,000 Ukrainian casualties[iii] and 315,000 Russian casualties[iv]. Ukraine and the West had no choice but to resist Russia’s invasion in February 2022. Whether a diplomatic solution could have averted the war or a peace settlement could have ended the war in early-2022 is up for debate. What’s indisputable is that Ukraine’s summer 2023 counteroffensive failed to achieve its goals. In 2024, Russia has both a decisive manpower and artillery advantage that will put Ukraine on its heels.

5. Peace in Israel will remain elusive

Even when the current Gaza war ends, permanent peace between Arabs and Jews will remain out of reach. Demographic factors (a high Orthodox-Jewish birthrate) will keep a two-state solution, the only realistic possibility for lasting peace, a non-starter for Israel. The conflict will remain a bleeding ulcer.

6. Shift to multipolarity

The world is shifting from unipolarity with America as the sole superpower to multipolarity. Absolute US power is not declining but its relative power versus great power rivals like China and Russia is declining. Since 1991, China’s military spending has increased by 42x and Russia’s military spending has increased by 8x. In a multipolar order, no country is decisively all-powerful but one may still be strongest overall. For example, America may struggle to thwart China in its near-abroad (e.g. Taiwan) but may still be more powerful than China globally.

US leaders are still in a unipolar mindset. As the war in Ukraine, the war in Gaza, and other emergent crises stretch America, the shift to multipolarity will become more obvious. Will US foreign policy adapt?

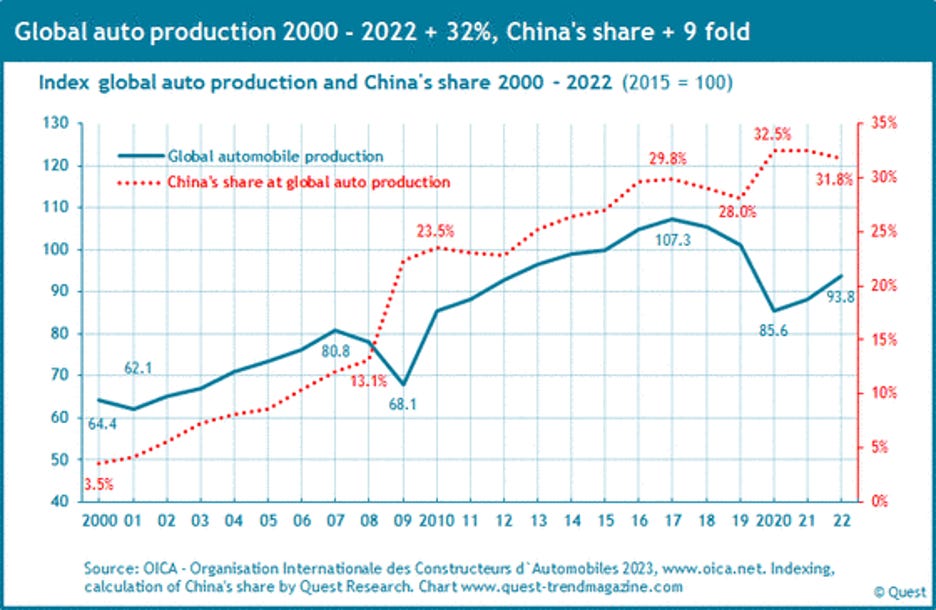

7. Chinese car manufacturing dominates

China quietly became the world’s largest automaker in 2009[v] and today makes one-third of all cars globally.

This includes a 60% share of all EVs made in the world[vii]. Auto manufacturing is a key industry in the US and Europe, which China’s dominance threatens. The Chinese manufacturing juggernaut will continue to capture a large share of the global automotive market going forward. Expect Europe and the US to limit Chinese auto imports in 2024.

8. US shale oil v OPEC+

There are two clear blocs in the global oil market: OPEC+ and the resurgent Western Hemisphere.

OPEC+ - mainly the Middle Eastern petrostates and Russia - is well established. To support member budgets, a high oil price is needed and OPEC+ has been cutting production to prop up prices. As a result, OPEC+’s market share has fallen from a recent high of 33% in 2017 to 27% in 2023, and over the long-term from 50% in the 1970s[viii].

The Western Hemisphere meanwhile, led by American shale oil, is ascendant. The USA set an all-time oil production record in 2023 at over 13 million barrels per day[ix]. Meanwhile, a massive offshore oil discovery in Guyana has risen from 0 in 2019 to a projected 1.2 million barrels per day by 2027[x]. To underscore the point, ExxonMobil, an American oil firm with a global footprint, plans to spend 70%+[xi]of its total $25 billion capital expenditure in 2024[xii] in the Western Hemisphere.

9. The North American Drug War simmers

The forever war closest to home will continue simmering against the cartels in Mexico. If a Republican administration is elected in November 2024, expect this conflict to escalate.

10. The anti-establishment populist wave continues

Economic conditions are poor and migration is up across the Western world, especially in Europe. As a result, establishment political parties are under assault by anti-establishment populist parties. This has been exacerbated, but is not the sole result of, an increasingly fragmented information space. This trend will continue in 2024 with potentially significant electoral implications.

Year of Democracy

2024 will once again prove the resilience of democracies worldwide, with a packed election calendar from Taiwan to the United States. The intersection of exponential technological advancements and the geopolitical shift towards a multipolar world underscores the complexity of this era. These trends, while diverse, are interconnected and illustrate a world in flux. Whatever happens in 2024, Ad Astra will cover it with objective analysis that hopefully helps you navigate a complex world.

Thanks for reading in 2023 and happy new year!

[i] https://www.bloomberg.com/news/articles/2023-11-01/brace-for-elections-40-countries-are-voting-in-2024?srnd=politics-vp&sref=nXmOg68r&embedded-checkout=true

[ii] https://www.economist.com/briefing/2022/12/08/rising-interest-rates-and-inflation-have-upended-investing

[iii] https://www.nytimes.com/2023/08/18/us/politics/ukraine-russia-war-casualties.html

[iv] https://www.reuters.com/world/us-intelligence-assesses-ukraine-war-has-cost-russia-315000-casualties-source-2023-12-12/#:~:text=WASHINGTON%2C%20Dec%2012%20(Reuters),the%20intelligence%20said%20on%20Tuesday.

[v] https://www.statista.com/topics/1050/automobile-manufacturing-in-china/#topicOverview

[vii] https://www.eastasiaforum.org/2023/11/21/chinas-electric-vehicle-surge-will-shock-global-markets/#:~:text=In%202023%2C%20production%20it%20expected,ranging%20from%20US%245000%E2%80%9390%2C000.

[viii] https://www.reuters.com/business/energy/opec-faces-declining-demand-shrinking-market-share-early-2024-2023-12-28/#:~:text=As%20of%20November%202023%2C%20OPEC%27s,from%20the%20group%27s%20monthly%20reports.

[ix] https://www.forbes.com/sites/rrapier/2023/12/15/us-producers-have-broken-the-annual-oil-production-record/

[x] https://www.spglobal.com/commodityinsights/en/market-insights/podcasts/oil/080323-guyana-crude-exploration-production-drilling-offshore-prices#:~:text=It%27s%20a%20country%20where%20in,barrels%20per%20day%20of%20production.

[xi] https://www.wsj.com/articles/exxon-chevron-focus-on-oil-projects-in-the-americas-11672698644

[xii] https://corporate.exxonmobil.com/news/news-releases/2023/1206_exxonmobil-corporate-plan