Related

Taking a Blow Torch to Big Tech

Key takeaways

Apple's Growth and Impact: Apple has revolutionized technology and social life with the iPhone, selling 2.6 billion units and achieving over $1 trillion in sales since 2007. The company now has a market capitalization of $3.2 trillion.

Offshoring: Apple manufactures most products in China due to lower costs, maintaining high profit margins. Shifting production to the U.S. would slightly reduce these margins but could benefit American industry.

Stock Buybacks: Apple has spent $500 billion on stock buybacks since 2012, boosting share value without increasing productivity. This practice, legal since 1982, diverts funds from potential innovations and other investments.

Monopolistic Practices: Apple dominates the smartphone market, notably through its App Store, where it imposes a 30% fee on purchases. This monopolistic behavior highlights broader issues of unchecked market power, calling for stricter regulation and enforcement.

In the summer of 2009, I had completed my freshman year at the University of Kansas and stayed in Lawrence, KS to take summer classes. I had a flip Motorola Razr cell phone but was eager to buy the new iPhone with 3G, making mobile internet browsing possible. I camped in the AT&T store parking lot for the iPhone’s midnight release, along with scores of others. Fast forward to 2024, the iPhone has changed the world. More than just a consumer electronics device, the iPhone has transformed social life, interior design, and even human posture. 2.6 billion[i] iPhones have been sold since it debuted, accounting for over $1 trillion in sales[ii] to Apple. It is the best-selling product, of any kind, in history.

Apple’s market capitalization is $3.2 trillion, the second biggest company in the world[iii]. It became the first $1 trillion company in 2018[iv], was the biggest company in the world from 2011[v] to 2024, and has ranked among the 5 biggest companies in the world since 2010[vi]. If you had invested $100 in Apple at the first iPhone’s release, you’d have $7490 today[vii]. Much of this success is due to the iPhone, which is enormously profitable on a per unit basis. As a result, the company has amassed a huge cash stockpile, having at one time nearly $300 billion[viii], bigger than the economy of Finland[ix].

But all this financial success has a darker side. Setting aside any sociotechno criticisms, Apple’s rise is emblematic of the perversion of American capitalism. In this article, I’m going to focus on Apple’s offshoring of manufacturing, stock buybacks, and monopolistic behavior as microcosms of the broader US economy.

Designed in California, made in China

Apple makes most of its products, including the iPhone, in China. It does this because labor, and other costs, are cheaper. It is estimated that Apple supply chains in China support 3 million jobs[x].

Zeroing in on the iPhone, its gross margin, or how much money Apple makes per unit sold, is very high. According to 9to5Mac in 2023, producing an iPhone 14 Max is estimated to cost Apple around $454[xi] per unit. At release, each phone sold for $1099, implying Apple profited $645 per phone (a 59% gross margin). Its very difficult to estimate, but a 2016 MIT study estimated making the iPhone in the US would cost 5% more[xii], so the gross margin would fall to 57%. Apple would ONLY make $622 per phone in this scenario, hardly endangering their profitability. Over time, that 5% cost increase may fall as US workers become more productive through training, the manufacturing process is optimized, and the design of the iPhone changes based on manufacturing feedback.

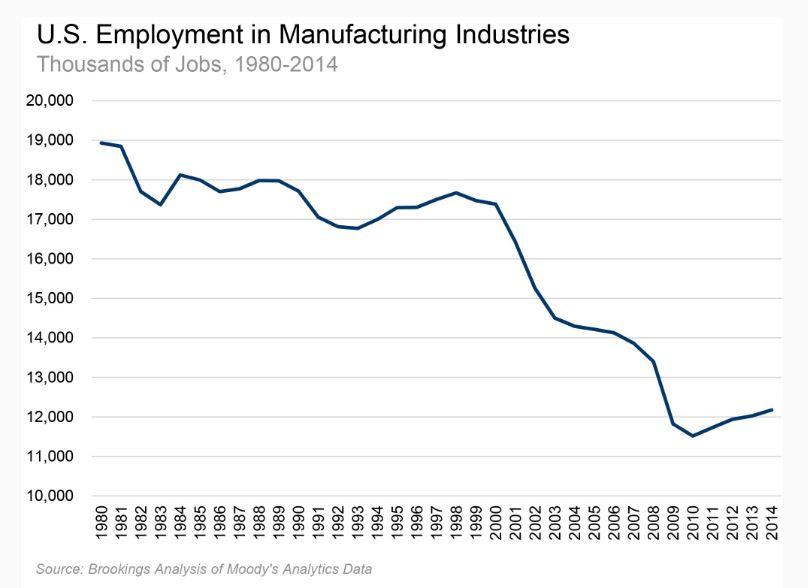

I don’t blame Apple for this situation. These are the rules of the game and Apple is playing by the rules. I do however, blame policymakers who have presided over the wholesale decimation of American industry through offshoring.

Stock buybacks

When a company buys back its stock, the shares outstanding are reduced and the value of each remaining share outstanding increases. For example, if a hypothetical company has 10 shares outstanding and is worth $100, then each share is worth $10. If the company buys 1 share back, then there are 9 shares left outstanding but the company is still worth $100. So, each remaining share is worth $11.11, earning investors $1.11/share without becoming more profitable or physically doing anything. Modern companies engage in this sort of financial engineering all the time.

Since 2012, Apple has used its massive cash stockpile to conduct $500 billion[xiii] in stock buybacks, the largest share repurchase program in corporate history. That money could have been used to fund R&D on future innovations, manufacturing facilities improvements to reduce costs, or taxes to the government.

Again, I don’t blame Apple for this. The SEC only permitted stock buybacks starting in 1982[xiv].

Monopolistic practices

There are many different ways that Apple abuses its market power. The government is currently suing Apple on antitrust grounds for monopolizing the smartphone market[xv]. For this article, I’m going to focus on the App Store. If you own an iPhone - 59%[xvi] of the American smartphone market is iPhone - you know that you’re forced to use the official Apple App Store to install any new app. Understanding their power, Apple takes a 30% fee[xvii] from all purchases in the App Store. Additionally, it wields existential influence over the independent app developers who are forced to use the App Store. This is textbook robber baron behavior.

I don’t blame Apple, or any of the other Big firms, who has been allowed to get away with this behavior for the last 40 years. I do blame the regulator, who until recently, has not enforced monopoly law.

Repairing Capitalism

All of these deformations of American capitalism can be fixed with simple policy changes.

To stop offshoring, any firm that sells into the American market but manufactures elsewhere should pay a tax. This is economically equivalent to a tariff, which Ad Astra has previously argued for.

To stop stock buybacks, the SEC should reverse its 1982 rule permitting them (previously argued for).

To stop monopolistic behavior, the government should break up Big Tech and aggressively enforce existing monopoly law. The current FTC and DOJ are actually doing this and should continue, even if a different Administration is elected in November. Ad Astra previously advocated for stricter antitrust enforcement.

While Apple stands as a monumental success story in the annals of American capitalism, its journey is also a testament to the systemic flaws within that current system. The company’s reliance on offshore manufacturing, extensive stock buybacks, and monopolistic practices underscore the broader issues of deindustrialization, financial engineering, and unchecked market power. These practices, while legal and profitable, have contributed to the erosion of American industry, society, and politics. Fixing these issues takes simple policy interventions but significant political will, realigning corporate practices with the broader common good.

[i] https://www.bankmycell.com/blog/how-many-iphones-have-been-sold/

[ii] https://techjury.net/blog/how-many-iphones-have-been-sold-worldwide/

https://companiesmarketcap.com

[iv] https://appleinsider.com/articles/18/08/02/apple-hits-1-trillion-market-cap-the-first-company-ever-to-hit-milestone

[v] https://www.macrumors.com/2018/08/09/apple-most-valuable-company-anniversary/

[vi] https://www.visualcapitalist.com/a-visual-history-of-the-largest-companies-by-market-cap-1999-today/

[vii] https://www.fool.com/investing/2024/02/02/how-much-apple-stock-gained-each-year-since-2007/#:~:text=The%20stock%20has%20been%20a,now%20be%20worth%20%241.1%20million.

[viii] https://www.cnbc.com/2020/01/28/apple-q1-2019-cash-hoard-heres-how-much-cash-apple-has-on-hand.html

[ix] https://www.worldometers.info/gdp/gdp-by-country/

[x] https://www.isacjobs.com/job/job-openings-at-apple-china/#:~:text=Through%20our%20supply%20chain%2C%20sourcing,App%20Store%20since%20its%20launch.

[xi] https://9to5mac.com/2023/02/13/how-much-iphone-14-cost-apple-to-make/

[xii] https://www.technologyreview.com/2016/06/09/159456/the-all-american-iphone/

[xiii] https://stockbuybackshistory.com/aapl/

[xiv] https://casten.house.gov/media/in-the-news/theres-a-reason-why-stock-buybacks-used-to-be-illegal#:~:text=For%20most%20of%20the%2020th,the%20C%2DSuite%20tool%20shed.

[xv] https://www.justice.gov/opa/pr/justice-department-sues-apple-monopolizing-smartphone-markets

[xvi] https://explodingtopics.com/blog/iphone-android-users#

[xvii] https://tms-outsource.com/blog/posts/apple-app-store-fees/

Well said Greg! I fully agree with the need to impose, or at least enforce, rules to avoid monopolistic corporations in the U.S.