The failure of SVB

If a white knight does not step in to support the depositors of SVB by Monday morning, contagion could sweep through the US financial system

Silicon Valley Bank (SVB) was taken over by the state regulator on Friday, making it the second largest bank failure in US history. SVB was the 16th largest bank in America and specialized in technology startups in Silicon Valley, funding nearly half of all venture capital-backed startups[i]. By most accounts, SVB was a healthy regional bank, widely used in Silicon Valley, and had a healthy balance sheet before this week.

In Ad Astra’s 2023 preview, we predicted trouble for tech after Elon Musk’s takeover of Twitter and sweeping layoffs:

What Musk found at Twitter is also true of many other tech companies, which have enjoyed an incredible run over the last decade (some would call it a bubble). Musk fired half of Twitter’s staff and the platform still works fine. The markets took notice and will enforce the same discipline across Silicon Valley. Other major tech firms have already announced layoffs. In a great irony, instead of unemployed coal miners “learning to code”, it will be laid off software engineers that need to “learn to mine”.

The failure of SVB was collateral damage in this broader tech-reckoning. In a cruel twist it is not Big Tech at risk, but rather hundreds of smaller tech startups that represent the future of American innovation. If a white knight does not intervene by market open Monday, “little tech” will be decimated and the US risks a full-fledged financial crisis.

Mechanics of a Bank Failure

Banking is built on confidence; when confidence is lost a bank run can quickly destroy an institution. When customers deposit money in a bank, 100% of that money is not stored in the bank vault. It is assumed not all depositors will withdraw all their money at once. Rather banks use deposits to make loans and conduct other financial operations. What money they do hold isn’t all cash and can include bonds, mortgages, and other financial securities. The ratio of deposits to these assets is called the reserve ratio. As an example, if hypothetical BankCo held $100 billion in deposits and held $10 billion in cash, bonds, and other liquid securities its reserve ratio would be 10%.

In the case of SVB, two things have happened recently, both bad:

1. As the tech sector has entered a downturn, firms have reduced their deposits.

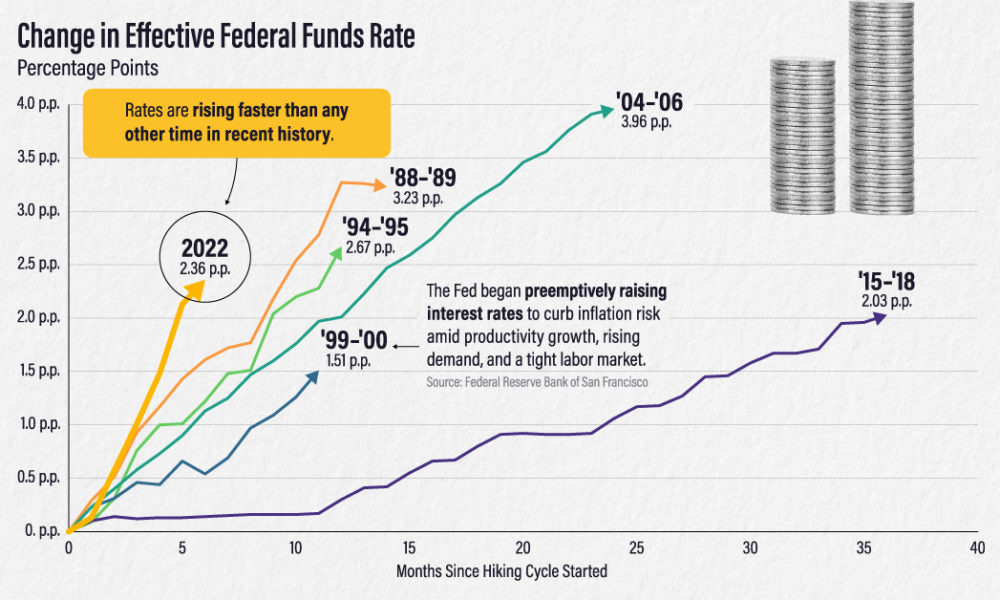

2. SVB held a large number of bonds as reserves. As the Federal Reserve has recently raised interest rates at the most rapid pace in modern history to combat inflation, the value of those bonds collapsed. For bonds, when interest rates go up, their prices go down.

When SVB needed cash to give to depositors, they had to sell these bonds at a huge loss. This had to be reported and word got out, sparking depositors to withdraw their money and initiated a bank run. Withdrawals quickly exceeded reserves, the bank failed, and regulators stepped in. Deposits up to $250,000 are insured by Federal Deposit Insurance Corporation (FDIC), but for firms with millions in the bank that amount is immaterial. SVB had $151 billion in uninsured deposits at the end of 2022, according to filings[ii].

History of Bank Runs

Bank runs and financial panics are prevalent in American history. The Federal Reserve was created in 1913 in response to the large number of bank runs that had occurred in the nineteenth and early-twentieth century. A large number of bank failures occurred at the onset of the Great Depression until newly elected US President FDR declared a national banking holiday to restore confidence in the system. One of the protections introduced by FDR was FDIC, which was federally-backed insurance on deposits so that depositors were partially protected in the event of a bank run. More recently, the 2008 Global Financial Crisis featured bank runs around the world. Lehman Brothers, a NYC investment bank, was allowed to fail by the government. Some have called the failure of SVB a “Lehman moment”. The 2008 crisis led to many new rules, including increased reserve requirements for “globally systemic” banks. Others have called these banks “too big to fail”. The reforms have been deemed so successful that current Treasury Secretary Janet Yellen has remarked that another financial crisis like 2008 was not likely “in our lifetime”[iii].

Contagion?

The risk with SVB’s failure is that people lose confidence in other regional banks and begin a run on them, a scenario called contagion. Depositors will ask “if SVB, the 16th largest bank in the US, failed, how are other large banks safe? Those banks also hold bonds.” The concern is valid and the risk is a system-wide run on regional banks.

Three Bad Outcomes

First, this will be a mass extinction event for startups if deposits aren’t fully kept whole. Many of these firms, through no fault of their own, will not be able to make payroll within weeks if they lose their deposits. And for the majority justifiably upset with Big Tech’s behavior recently, this will affect “little tech”, the hundreds of scrappy startups that make Silicon Valley, and America, the most state-of-the-art place in the world. The loss of this ecosystem would set back innovation for a decade and hurt US competition with China.

Second, a possible run on regional banks will concentrate deposits with top 5, “too big to fail” banks. This would increase big banks monopoly power and make our financial system more fragile.

Third, if contagion takes hold and multiple regional banks fail, this could become a full-blown financial crisis. Every small business that banks with regional banks could find themselves not being able to make payroll. Hundreds of thousands could lose their jobs and the country could slip into recession, or worse.

All of this, if it happens, will happen quickly after the market opens Monday morning unless action is taken to reassure the markets before then.

A Plan to Avoid Crisis

A white knight should purchase SVB’s assets and keep all depositors whole. A white knight is a financial actor, and could be a major bank, someone with lots of resources (like Warren Buffet), or as a last resort the federal government. A white knight is not doing this out of charity and stands to profit from the underlying assets, which are still fundamentally strong.

A representative of the Biden Administration should hold a televised press conference before Monday to reassure the markets.

After 2008, a large segment of the population is understandably against any form of bank bailout. This is not a bailout and in no scenario can taxpayer money fund bank executive bonuses. The small tech startups at risk are in this situation through no fault of their own. It would be a different story if this was the result of overly speculative behavior or bad products on the part of the tech startups.

Longer term, the FDIC should increase insurance limits for commercial accounts from $250,000. As the Federal Reserve has raised interest rates at the most rapid pace in modern history, all banks face declining bond values. The Fed should slow the pace of interest rate hikes to allow the financial system time to adjust.

The failure of SVB could be isolated and the fallout limited to local tech, but why take that risk?

[i] https://nypost.com/2023/03/10/what-is-silicon-valley-bank-and-why-did-it-suddenly-collapse/

[ii] https://nypost.com/2023/03/10/what-is-silicon-valley-bank-and-why-did-it-suddenly-collapse/

[iii] https://www.cnbc.com/2017/06/27/yellen-banks-very-much-stronger-another-financial-crisis-not-likely-in-our-lifetime.html#