Figure 1: Henry Clay in the US Senate, illustrated by AI

Key takeaways

Critical Neglect: Both presidential candidates sidestep the looming federal budget crisis, ignoring its profound impact on everyday life, from housing costs to grocery bills

Unsustainable Trajectory: Federal deficits have spiraled to triple their historical average, with potential consequences including skyrocketing mortgage rates, inflation, and devaluation of the US dollar

Radical Solutions Required: Embracing fundamental reforms is necessary to steer the federal budget towards sustainability. This includes harnessing AI to rein in Medicare costs, rethinking defense spending with a focus on effectiveness, modernizing the Fed, and fostering economic growth.

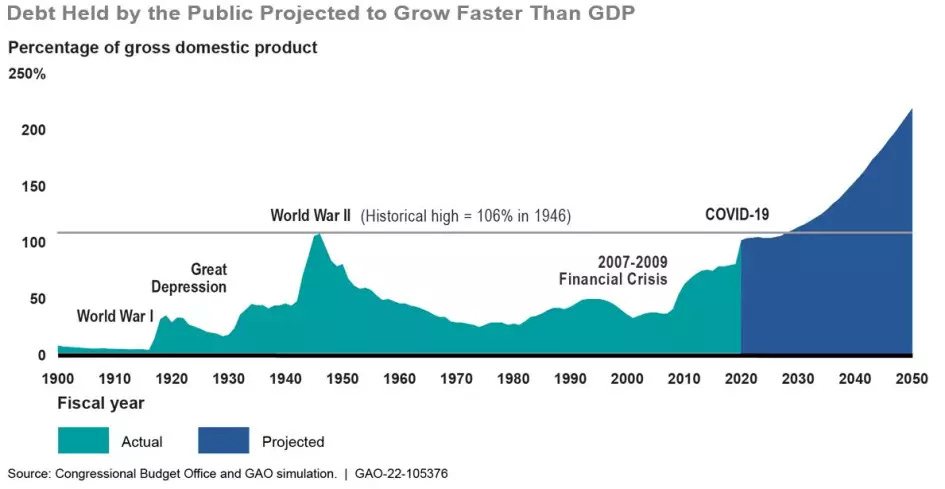

Neither Joe Biden nor Donald Trump is talking about the federal budget in the 2024 US Presidential election. Perhaps they avoid it because it’s seen as boring or too complex for voters to understand, but is critical to your everyday life and affects how much you pay for a home, the price of groceries at the store, and the quality of your children’s lives. In the 21st century, America has been living unsustainably and the federal debt has reached the same level as after WW2, when we fought a global war, armed Europe, Russia and ourselves, and defeated totalitarianism.

Before we begin, its important to define some key terminology. The annual deficit is the difference between federal spending and revenue (taxes). If spending is more than revenue, the government has to borrow money. The way government borrows is by selling bonds. A bond is an IOU where an investor gives the government cash today to plug the deficit, in return for payment at some future date plus interest. The interest rate is set by the Fed. The sum of all bonds outstanding is the federal debt.

In 2024, the federal budget including interest is $6.4 trillion, the deficit will be $2 trillion, and the current debtof $34 trillion will become $36 trillion.

Federal deficits have exploded and we are presently on an unsustainable path. The deficit in 2023 was 6% of GDP, which is 3x the 1970-2007 average of 2%.

Without changes, mortgage rates and inflation will eventually skyrocket and the US dollar will become worthless. No one can say when that will happen. It could happen next year, in 10 years, or it may have already begun, but it’s a law of physics that it will eventually happen.

In this article, I will propose reforms to put the federal budget back on a sustainable path. To do so, I made a model of the federal budget using Congressional Budget Office (CBO) data. The reforms I will discuss are changes to Medicare, defense spending, the Fed, and taxes. Let’s dive in.

Medicare

The federal budget is comprised of mandatory and discretionary spending. As the terms imply, mandatory spending is mandated by law an is very hard to change. Mandatory spending includes things like Social Security and Medicare, a government fund to pay for retiree’s healthcare costs. The US pays more for healthcare and gets worse outcomes than any other advanced country. Medicare spending is a huge portion (20%) of the federal budget, is mandatory, and will grow as the Boomers age.

It is politically infeasible to reduce Medicare benefits or raise the retirement age. The only way to make Medicare sustainable is by reducing healthcare costs. Luckily, humans have invented a tool, AI, that will revolutionize healthcare. Giving healthcare professionals real-time access to unlimited knowledge and research will improve their effectiveness, make healthcare more proactive, and reduce costs. By reducing Medicare costs starting in 2028 by 15% versus the current baseline, Medicare costs can be brought under control. By redesigning the system to encourage preventative health rather than reactive acute care, this is an achievable national goal through a combination of public and private initiatives.

Defense

Defense spending is technically “discretionary”, but might as well be mandatory given the powerful interests that influence it. Hawks always want to spend more on defense while doves want to cut the defense budget. I believe this is the wrong way to think about it. Instead of more or less spending creating more or less security, respectively, we should care about how effective defense spending is. Ad Astra believes the US military should be by far the most powerful in the world, but it’s not clear the current US force is. That is despite an annual price tag approaching $1 trillion (20% of the federal budget). Aircraft carriers are exquisite pieces of military hardware, but they are also useless against many 21st century foes and have massive operating and maintenance costs. The military spends one-third of its $1 trillion annual budget on operating and maintenance costs, in peacetime.

The US military should undergo a ground up reassessment of its effectiveness against modern threats and phaseout expensive, 20th century hardware and stop buying new sophisticated, but useless, weapons platforms. The new force should include high-tech things like drones, AI, and other Silicon Valley weapons systems, but also focus on the fundamentals like artillery and recruitment, which modern war requires. America should also reform the defense industrial base into a world-class, 21st century warfighting machine. It's not clear what shape this new force will take or how much it will cost, but even if we maintain the CBO forecast for defense spending, a reformed military will be far more powerful and sustainable to the taxpayer.

The Fed

The Federal Reserve is an independent agency created in 1913[i] that sets interest rates to control inflation and unemployment. Much can be written about reforming the Fed and a future article will do just that. For this article, you’ll have to accept the argument that this 111-year-old institution is outdated and the way it controls inflation causes more harm than good. Interest expense is the budgetary item for what the government pays investors for holding bonds and currently makes up about $1 trillion (20%) of the annual budget, the same as defense spending. As the Fed raises interest rates, this expense will go up. The only way to have a sustainable budget and control inflation is to lower and maintain interest rates around 3%.

The largest contributor to inflation is rents and shelter costs. These costs are still above pre-pandemic growth rates everywhere in the country because there is a housing shortage. By increasing interest rates (to 5%+), the cost of building more apartments and houses has gone up. To increase the supply of housing, and thus bring rents down, interest rates need to fall. This runs counter to the macroeconomics textbook, but I’m arguing America’s 2024 economy has outgrown the textbook.

Figure 2: Rental inflation by region[ii]

Taxes

The most important and most powerful variable in the federal budget equation is the nations economic growth rate. If the economy grows more, there will be more tax revenue at the same expense level, closing the budget deficit. Over the nation’s history, tax rates have been much higher than today (the top marginal income rate was 94% in 1944-45). Yet overall revenue has never exceeded 19-20% of GDP[iii]. In 2024, tax revenue is expected to be 17.5% If taxes are increased today, individuals and companies will simply find new ways to shield their money from taxation or leave the country entirely. Despite increasing calls to “tax the rich”, that won’t solve the budget deficit. There’s undoubtedly a need for some tax reforms but the only way to materially increase revenue is by increasing the economy’s growth rate. We assume an increase of 1% per year in our model.

Boosting economic growth by 1% may not seem like a lot but moving the needle on something as large as the US economy is difficult. Of the many ways to boost economic growth, here are three examples. First, permitting in the US must be reformed. The average time it currently takes to get a permit to build a project is 5 years, longer than the time it took to build the Hoover Dam. The permitting roadblock prevents some projects from getting done and slows growth.

Second, the federal government should spend more on R&D, which boosts future growth. Federal R&D spending has been declining since peaking in the 1960s[iv]. The US industrial policy series shows how to do this.

Finally, a universal import tariff should be enacted. At first, this will raise significant revenue. Longer-term, it will incentivize firms to reshore, creating more economic activity and tax revenue in America. The world saw a large-scale experiment of tariff effectiveness after Russia invaded Ukraine in 2022. The West applied sweeping sanctions on Russia, basically an extreme tariff, limiting their imports and forcing them to reshore nearly all industrial capacity. Contrary to expert expectations, the economy boomed. Russian GDP growth was 4.9% in the final quarter of 2023[v], faster than the US. Tariffs are controversial because they threaten so many established interests, but they’re how the US built the continent out in the early-19th century.

The next American system

The Whig Party (now defunct), led by John Quincy Adams and legendary Senator Henry Clay advocated for the “American System” in the first half of the 19th century. To unite and grow the fledgling country, the “American System” sought to promote economic growth through four pillars: a high tariff to promote domestic manufacturing, high land prices to support tax revenue, a central US bank (precursor to the Fed), and infrastructure spending. It worked and the US became a superpower.

In 2024, it’s time for the next American system. By implementing the reforms outlined in this article, the US can stabilize the national debt:

Figure 3: CBO baseline forecast for federal debt vs Ad Astra plan

The silence from both sides of the political aisle on this issue in the 2024 US Presidential election is deafening, yet the consequences of inaction are far-reaching, affecting every aspect of daily life for Americans. As the federal debt balloons to unprecedented levels, it's evident that the time for comprehensive reform is now. This blog post has outlined a roadmap for such reform, tackling the thorny issues of Medicare, defense spending, the Federal Reserve, and taxation head-on. By embracing radical yet necessary changes, such as harnessing AI to revolutionize healthcare, reimagining defense strategy for the 21st century, modernizing the Fed, and fostering economic growth, we can chart a course towards a more sustainable future. Just as the American System of the 19th century propelled the nation to greatness, the next American system must rise to the challenge of securing prosperity and stability for generations to come.

[i] https://en.wikipedia.org/wiki/Federal_Reserve

[ii] https://www.bloomberg.com/news/articles/2024-04-18/us-rent-inflation-looms-over-potential-interest-rate-cut

[iii] https://fred.stlouisfed.org/series/FYFRGDA188S

[iv] https://ncses.nsf.gov/pubs/nsf23339

[v] https://tradingeconomics.com/russia/gdp-growth-annual