GDP is a bad way to measure the economy

In an era of demographic changes, GDP has become a bad all-encompassing economic measure

Tl;dr

· US GDP declined in the 2nd quarter, following decline in the 1st quarter

· GDP growth is heavily linked with population growth

· Populations around the world are set to decline, beginning in 2022

· GDP is biased to reward population growth and is not the best way to assess the health of the economy

· Instead of growth, we should care more about the quality of the economy and address specific economic issues such as higher education, the productivity of older workers, and inflation

The US is in a recession…right?

Second-quarter GDP figures were released today, and they weren’t pretty. -0.9%[i] growth in the second quarter follows -1.6% in the first quarter[ii]. The classic definition of a recession is two consecutive quarters of negative GDP growth, so we meet that definition. But pollical debate about what a recession is has started, so depending on what side you’re on, the US either is in (Republicans) or is not (Democrats) in a recession. This potential recession is historically odd in that unemployment is a relatively low 3.6%[iii]. As the old adage goes, “a recession is when your neighbor loses their job and a depression is when you lose yours”. So what’s going on here?

What is GDP?

GDP is a term often thrown around in the media as the all-encompassing measure of the economy, but less often explained. Gross Domestic Product (GDP) is the sum of all transactions for finished goods or services in an economy. For example, when you buy a new car (or a sandwich on Uber Eats), that is a transaction that is included. When you pay your monthly cell phone bill, that’s included. When the manufacturer you bought your car from buys a new piece of equipment to make more cars, that’s included. Government spending (like on a new naval ship) is also included. For those who like math, the formula for GDP is:

Figure 1: GDP Formula

Where C is personal consumption (the car and the sandwich), I is investment (the equipment for making more cars) and G is government spending (the new naval ship). Net exports are a country’s exports less its imports; the US typically imports more than it exports, so the term is negative.

For the US, the biggest term by far is always C, personal consumption. In the 2nd quarter of 2022, that was $3.5 trillion (71% of total GDP)[iv]. As such, personal consumption closely tracks population. Makes sense: more people, more sandwiches, higher GDP. In the US, and in most of the rest of the world, population has only gone up and GDP has followed. But what happens when population goes down?

Population Decline

To answer this question, first we have to go back, way back, to the Industrial Revolution. Everyone used to live on rural farms, where they grew their own food. Farming is hard, back-breaking labor and kids tended to be free labor for the family. On average, families had 5 children[v] to help them toil in the fields. Then in the 19th-century, new machines were invented like the steam engine and the mechanized loom. These inventions revolutionized industrial production (hence Industrial Revolution) and tended to be concentrated in cities. Thus, people began to migrate from the farm to the city for jobs, in a process known as urbanization. In the city, extra help wasn’t needed on the farm so kids were only an extra cost. As a result, birthrates plummeted. This process continues to this day for a number of reasons (for example, raising kids is just more expensive in many urban areas). Today the birthrate is around 1.5[vi] for most advanced economies. For reference, it takes 2.1 kids/family just to hold the population steady because it takes 2 people to make a baby (more information on this topic can be found elsewhere on the internet) and the extra 0.1 compensates for infant mortality, premature deaths, etc.

What does this have to do with GDP?

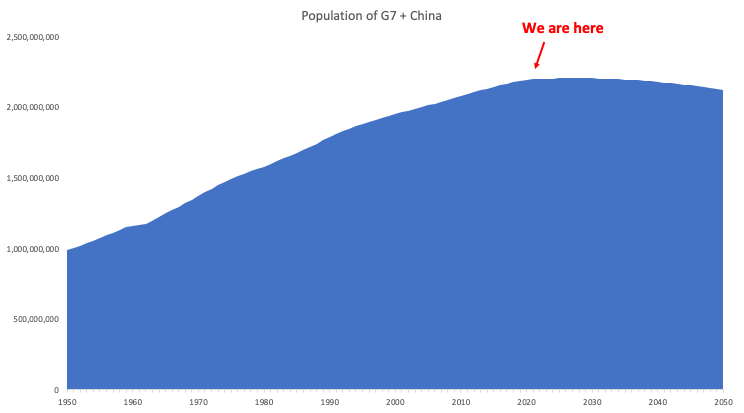

GDP is heavily impacted by personal consumption and personal consumption is directly linked to population. In a total vibe shift, the populations of the advanced economies of the world are about to mostly contract after growing for the last seventy-plus years. Figure 2 shows the combined populations of China plus the G7, which together make up more than 60%[vii] of global GDP. The G7 is a group of seven rich countries that make up a large share of economic activity in the world: the US, Germany, Italy, Japan, Canada, France and the United Kingdom.

Figure 2: Population of G7 and China[viii]

As you can see, we are on top of a hill and as of 2022, it’s all downhill from here. The US population is actually expected to keep growing (more on that later) but not enough to offset the rest of the decline. The biggest driver of this decline is China.

It shocked the world this year when the United Nations announced that China’s population had peaked at 1.4 billion and had begun to decline. By 2100, China’s population is expected to be 600 million, less than half of what it is today. Population decline in China is particularly severe because of the One Child Policy.

The US will continue its population growth thanks to the Baby Boomers, which is the largest generation in US history. After WW2, many soldiers came home and generated more than 2.1 kids each. This stands in contrast to other WW2 combatants, who had their military aged male populations decimated by the war. The Baby Boomers went on to produce the Millennials, a large echo generation.

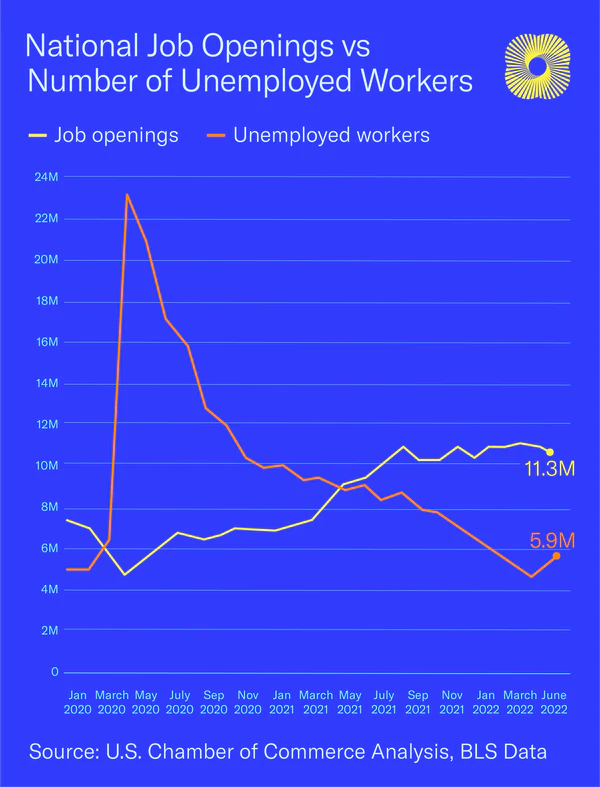

As mentioned early in this article, US GDP shrank in the second quarter triggering the technical definition of a recession. This was unexpected by the experts (who collectively expected 0.3% growth) and is historically odd as far as recessions go as the unemployment rate is a low 3.6%. Unemployment is typically high during recessions. We aren’t suffering from high unemployment, the opposite is true: businesses can’t hire enough workers. As Figure 3 shows, the number of job openings is about twice the number of unemployed people.

Figure 3: Job openings and unemployment[ix]

This is in large part due to COVID-19, which caused more than 3 million between the ages of 55 and 65 (Baby Boomers) to retire early and leave the workforce as part of the Great Resignation. They had many reasons for retiring early, but in general the combination of COVID hassles (remote work) and sufficient retirement savings made them decide to retire. The result was a combination of a demand and supply shock to US GDP. It negatively reduced personal consumption because retirees on a fixed-income tend to consume less than a young family with multiple kids in school. And it negatively impacted the labor supply so even a business that wanted to generate economic activity by hiring someone couldn’t find workers. Perhaps you’ve noticed shops or restaurants randomly closed recently.

Luckily, the US population is expected to continue growing, albeit more slowly than in recent decades[x]. But the real kick will come in the 2030s, when the Millennial’s kids start to join the workforce. So instead of making fun of Boomers for their inability to understand the internet, thank them for the demographic bounty they have bequeathed on the US. But until then, expect anemic workforce growth in the US and generally grim decline in many of the other major economies of the world.

In summary, GDP is biased to reward population growth to measure economic performance. In an era of slowing population growth in the US and declining population growth abroad, GDP is not the best way to assess the health of the economy. As far as if the US is in a recession, I’m not an economist and will leave that to the experts. But in my view, that question is beside the point. Inflation is at a 40-year high, consumer sentiment is at an all-time low, and housing is out of reach for many. This is a bad economy for consumers, especially the working-class.

Recommend action

We can’t take any steps to avoid the imminent demographic cliff. To do so would have required intervention in the bedroom twenty years ago. But we can recalibrate expectations and focus on other measures of wellbeing.

Additionally, we can take these specific actions to improve the economy in the US:

1. Reform the higher education system

2. Make older workers productive longer

3. Reduce inflation now by increasing domestic energy production

One of they key problems of the current American labor shortage is the job openings gap: there are more job openings than people who are unemployed and seeking work. This implies that the current unemployed don’t have the right skills to fill the open jobs. Additionally, currently employed persons aren’t as prepared for their jobs as they could be. In economic theory, increasing the education of the labor supply increases labor productivity. A more productive workforce is a key component of making a healthy economy. This doesn’t even consider the exorbitant (and increasing) cost of higher education in America. Higher education is broken in the US, that is a drag on the economy, and will be a future topic on this Substack.

In order to make do with the workforce we have, we need to keep older workers productive longer. For example, my mom is 64 and still teaches fitness classes at the YMCA. I don’t expect her to retire at 65. For some like her, this is a choice. Others may need to be incentivized to stay in the workforce with flexible work arrangements, increased benefits or other perks. The Bureau of Labor Statistics (BLS) already assumes this will happen in their workforce forecasts. The number of people 65-69 participating in the workforce in 2000 was 24.5%. By 2030, that figure is expected to reach 39.6%[xi].

Inflation directly reduces consumer spending (C) and hurts GDP. For example, consumers forgo some discretionary spending to pay for essentials like food, gas, and utilities. Perhaps you’ve experienced this firsthand. The previous post on this Substack was about how inflation can be brought down. The US Federal Government should take those steps immediately.

Demographics unbound

There is no end to what demographics can tell us about the future, from geopolitics, to national budgets, to economics, etc. And since you can’t clone 30-year-olds, demographics are the most certain predictive measure we have. If you’re interested, I recommend anything written by Peter Zeihan (his latest book is The End of the World is just the Beginning: Mapping the Collapse of Globalization) and The Great Demographic Reversal for further reading.

[i] Bureau of Economic Analysis

[ii] Bureau of Economic Analysis

[iii] BLS

[iv] Bureau of Economic Analysis

[v] Zeihan, Peter. The End of the World Is Just the Beginning: Mapping the Collapse of Globalization. Harper Business, 2022.

[vi] Zeihan, Peter. The End of the World Is Just the Beginning: Mapping the Collapse of Globalization. Harper Business, 2022.

[vii] IMF

[viii] UN

[ix] US Chamber of Commerce

[x] BLS

[xi] BLS

Another excellent article! Your candid, straight forward approach in enjoyable to read.