Housing and the American Dream

Declining housing affordability threatens to stall the engine of social mobility

Related

America 2040: The rent is too damn high

Key takeaways

· Skyrocketing housing costs: Home prices have surged 47% since 2020, pushing the median price to five times the median household income

· Inequality: Homeowners have a median net worth of $255,000 compared to $6,300 for renters

· Economic multiplier effect: Home purchases stimulate economic growth through spending on renovations, furnishings, and related services, supporting jobs and contributing to the local economy

· Social stability and community engagement: Homeownership fosters stability, better educational outcomes for children, increased community involvement, and higher voter turnout

· America Bonds for affordable housing: To address the housing affordability crisis, the federal government should guarantee 3% interest rate mortgages funded by selling tax-free America Bonds

The prospect of owning land, and therefore owning a home, has been central to the growth and development of America. The lure of abundant, cheap land drew European immigrants to the original 13 colonies and later, the early US. The Abraham Lincoln-era Homestead Acts provided free land to settlers and was the motor of westward expansion. The post-WW2 GI Bill provided millions with federally guaranteed home loans, building modern America and the middle class.

But in the early 21st century and especially after the pandemic, housing costs have dramatically increased, starving the engine of American prosperity. Since early 2020, home prices have risen an eyewatering 47% and are currently 5x the median household income, up from the historical norm of 3x. Likewise, more people are renting, which does not lead to wealth accumulation.

In this article, I’m going to argue that home ownership promotes social mobility and a host of other benefits. The result separates American suburbia from European apartment blocks and the Asian mega-cities.

Economic benefits

Buying a home is the first rung on the ladder of wealth accumulation for most families or individuals. Building equity in a home, which typically increases in value over time, can be a springboard for other investments. Miss this rung and you’re missing out on the compounding benefits of owning an appreciating asset. According to the Federal Reserve in 2019, homeowners in the US had a median net worth of $255,000, while renters had a net worth of just $6,300, a difference of 40x[i].

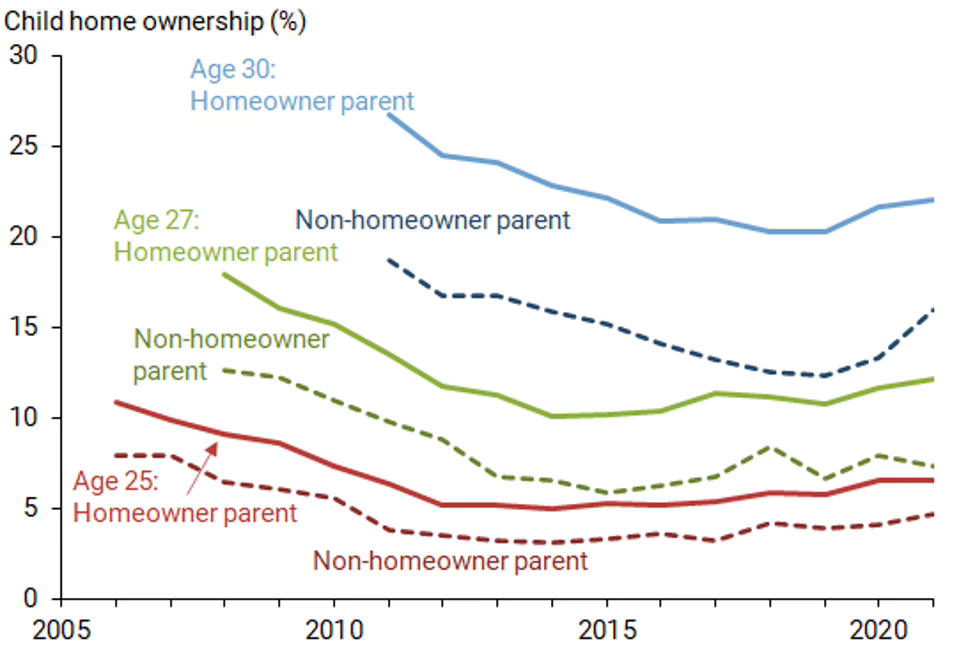

Second, homeownership is also a means of intergenerational wealth transfer, allowing each successive generation to stand on the shoulders of the one before it. Young adults are more likely to own a home if their parents are homeowners than if their parents are renters. According to the San Francisco Fed, by age 30 a child of homeowners will have 39% more housing wealth than a child of renters[ii].

Third, homeownership has broad, positive impacts on the local economy through the multiplier effect. When people buy homes, they also spend on renovations, furnishings, and other home-related goods and services, which stimulates economic growth and job creation. Housing contributes to the US Gross Domestic Product (GDP) in two ways: 1) homebuilding, which makes up 3-5% of GDP, and 2) consumption spending on housing services, such as utilities and renovations[iv]. Additionally, as home owners accumulate 40x extra income, they spend some of that money in the local economy by eating at restaurants, going to a sports game, or buying a car. According to NAR, one new job is supported from every two home sales[v].

Social benefits

There are also many positive social outcomes from homeownership.

First, research shows that children of homeowners tend to have better educational outcomes[vi]. Homeownership provides stability which is conducive to academic success.

Second, in addition to promoting local economic growth, homeowners are more likely to be engaged in their communities, participate in local elections, and be involved in community organizations. This increased engagement can lead to better community resources, safer neighborhoods, and stronger social networks. The US Census Bureau found that 58% of eligible homeowners voted in the 2022 midterm elections, but just 37% of eligible renters cast their ballots[vii]. The 21-point voter turnout gap between renters and homeowners is 2 percentage points wider than the gap in the 2018 midterm elections[viii].

Third, homeownership provides a sense of stability and security that renting does not. This stability can lead to better job performance and career advancement, as well as reduced stress and improved health. HUD (Department of Housing and Urban Development) has highlighted these benefits over time[ix].

Renter nation

High home prices have led to less home ownership in recent years and more renting. Homeownership is 65.7% in 2024, down 4.5% from a high of 69.2% in 2004[x]. More recently, homeownership peaked at 67.9% in early 2020 but has fallen almost 2% since (about 7 million people)[xi].

Given the clear economic and social benefits of homeownership, the federal government should guarantee 3% interest rate mortgages, which make a monthly mortgage payment about $1100 less than a market rate mortgage. It should fund theses mortgages by selling tax-free America Bonds to wealthy Baby Boomers. America Bonds would be similar to WW2-era War Bonds.

Housing affordability is a critical issue threatening the American Dream and social mobility. History shows that access to affordable housing has long been a cornerstone of American prosperity, from the Revolutionary-era, to the Homestead Acts, to the post-WW2 GI Bill. However, the current housing market, with home prices up 47% since the pandemic, is stifling the ability of many Americans to achieve homeownership. Addressing this crisis through solutions such as government-backed low-interest mortgages is crucial for sustaining the economic and social benefits that homeownership provides. Without intervention, the dream of homeownership may become increasingly out of reach, undermining the very fabric of American society.

[i] https://www.cnbc.com/select/average-net-worth-homeowners-renters/#:~:text=In%202019%2C%20homeowners%20in%20the,40x%20between%20the%20two%20groups.

[ii] https://www.frbsf.org/research-and-insights/publications/economic-letter/2022/11/passing-along-housing-wealth-from-parents-to-children/

[iii] San Francisco Fed

[iv] https://www.nahb.org/news-and-economics/housing-economics/housings-economic-impact/housings-contribution-to-gross-domestic-product

[v] https://www.forbes.com/sites/lawrenceyun/2016/08/12/why-homeownership-matters/

[vi] https://wol.iza.org/uploads/articles/342/pdfs/does-homeownership-affect-education-outcomes.pdf?v=1

[vii] https://nlihc.org/resource/new-census-data-reveal-voter-turnout-disparities-2022-midterm-elections

[viii] https://nlihc.org/resource/new-census-data-reveal-voter-turnout-disparities-2022-midterm-elections

[ix] https://www.huduser.gov/portal/pdredge/pdr-edge-featd-article-061917.html

[x] https://fred.stlouisfed.org/series/RHORUSQ156N

[xi] https://fred.stlouisfed.org/series/RHORUSQ156N