Recurring themes on Ad Astra are the declining quality of American healthcare, particularly in rural areas, and the over-financialization of everything. This week’s story, from The Atlantic, combines both. The article, adapted from the author’s new book The Big Fail: What the Pandemic Revealed About Who America Protects and Who It Leaves Behind, explores how Wall Street firms are sucking the life from hospitals. We’re past Halloween, but the story is scary.

Riverton, Wyoming, a city of about 11,000 people at the feet of the Wind River mountain range, seems far away from the world of Big Finance. Yet like so much of America, Riverton has become well acquainted with the business that most epitomizes today’s Wall Street: private equity. In 2018, the local hospital, SageWest, was purchased by Apollo Global Management as part of the giant private-equity firm’s $5.6 billion deal to buy a chain of hospitals called LifePoint Health. Even before Apollo got involved, LifePoint had merged Riverton’s small hospital with the hospital half an hour away in Lander, the county seat.

instead of dividing specialties between the two hospitals and beefing up the ones remaining at each location, hospital managers were simply stripping away essential services from their community. The drive to Lander isn’t hard in the summer, but in the winter, the roads are often closed. Many more patients needed to be transported out of the county altogether. According to state data reported by The Wall Street Journal, the number of air-ambulance flights out of Fremont County grew sixfold from 2014 to 2019.

A nascent effort by a group of prominent Riverton citizens to build a new hospital intensified after the Apollo takeover. In addition to raising several million dollars via community contributions and donated land for the new Riverton Medical District, the group just closed a $37 million loan from the U.S. Department of Agriculture, which uses taxpayer money to help rural development efforts. This is hardly the only time that government dollars have been used to clean up after, or subsidize, private-equity firms’ self-enrichment. In Watsonville, California, state officials kicked in to help buy a local hospital out of bankruptcy after its own brush with private equity. During the pandemic, many hospitals owned by private-equity firms, run by billionaires and themselves flush with cash, got loans and grants from taxpayers.

the pandemic both exposed and exacerbated preexisting problems in America. One such problem is how financial engineering has helped hollow out our health-care system. Every struggling hospital’s story is painful in its own way, but Riverton’s woes are a snapshot of the turmoil that has engulfed the hospital sector in the almost three decades since private-equity funds—which use debt to buy companies with the ostensible goal of improving them—decided that the hospital business would make a good investment. By 2011, seven of the largest for-profit chains were owned by PE firms, according to the researchers Eileen Appelbaum and Rosemary Batt, who have written a number of articles and reports about private equity’s influence on health care.

According to the private-equity sales pitch, the money that investors earn is supposed to come from using their financial and operational savvy to make their portfolio companies more profitable—such as by bringing in new technology to companies that can’t afford necessary upgrades on their own. In reality, investors can prosper even when the underlying business fails.

To eke out gains, private-equity firms have cut nursing staff, slashed services, and even, in at least one case early in the pandemic, made an explicit threat to close an institution unless it received taxpayer money. Many hospitals purchased by private-equity firms have been forced to pay consulting fees to their new overlords for access to their strategic brilliance.

Far from setting troubled hospitals on a more sustainable path, PE investors’ forays into health care have mostly brought debt to essential institutions—and misery to patients and communities. In many instances, they’ve shown considerable rapaciousness and utter indifference toward the demands of running a hospital. As the pandemic underscored, hospitals are part of America’s vital infrastructure. Yet when investors take over a hospital and scale back services, sell its real estate, and weigh it down with rent payments on buildings that it used to own, the very people who depend on that institution don’t get any say in the matter.

According to the Private Equity Stakeholder Project, an advocacy group, almost 400 U.S. hospitals are still owned by private-equity firms. In deal after deal, private-equity-backed hospital companies made big promises about how the hospitals would improve. But the hospital business is hard. Over time, many PE-owned hospitals were sold off into less and less stable financial structures to pay down debt that wouldn’t have existed were it not for the previous dealmaking.

In a 2018 review of 390 private-equity deals, Daniel Rasmussen, a former Bain analyst who now runs an investment firm called Verdad, found little evidence of superior strategic insight, and that what PE consistently does across industries is not to bring great strategic wisdom to running businesses, but rather to add debt. “While debt magnifies positive returns and enhances the returns of good decision-making,” Rasmussen argued in American Affairs, “it can also cut the other way, exacerbating negative returns and punishing bad decisions.”

Even though private-equity firms still own many hospitals, they appear to have lost interest in acquiring more, at least based on deal announcements. But they have been piling into other areas of health care, including dermatology, mental health, and autism care, and exposing some of the most sensitive services to private equity’s single-minded focus on squeezing out profits. “If [private-equity firms] want to return a huge investment bonanza to people who invest in dog food, God bless them, go for it,” Watkins told us. “I believe medical care needs to be in a completely different realm.” Indeed, the private-equity foray into hospitals shatters any pretense that investors in a business do well only if everyone does well, and should remind Americans that some things ought to be more important than financial gains.

Interesting stat

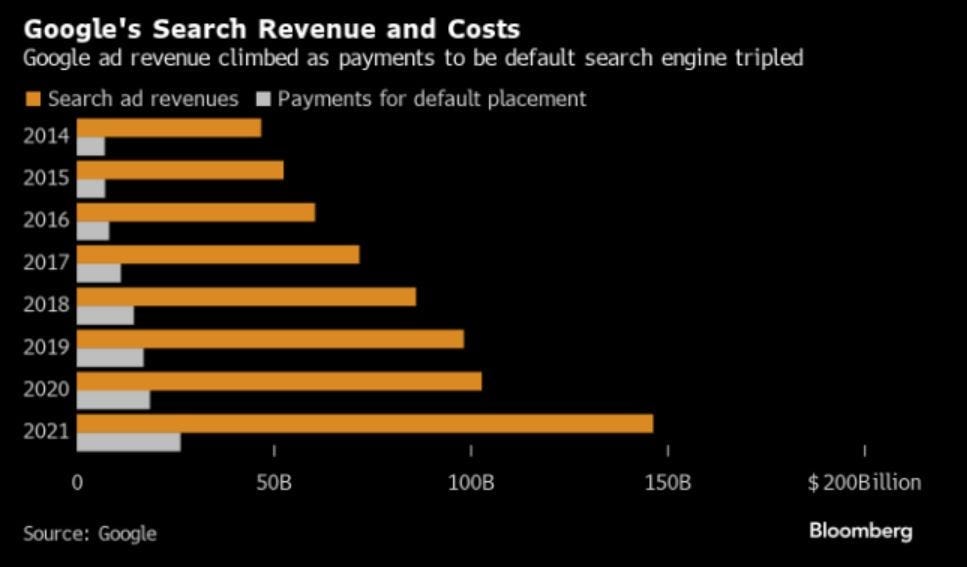

One of the most shocking statistics to come out of the government’s monopoly lawsuit against Google is how much it pays each year to be the default search engine. Ever wonder why Google is the default search engine on your mobile phone? Because Google pays phone-makers $26 billion per year for that right.

Media recommendation

This week, I recommend an interview of Walter Russell Mead on the podcast Honestly. Walter does a great job of explaining the historical context of the Israel-Hamas War and describes how it fits into the wider World Situation. Pure Ad Astra.

There you have it, the seventeenth edition of Sunday Digest featuring vampiric financiers in health care, search engine monopolies, and how WW3 unfolds. The portrait of a world spinning faster and faster. The good news is you have Netflix, Uber Eats, and running water. Until next time, be a good citizen, quit doomscrolling, and go outside.

Ad Astra Per Aspera!