The Gathering Storm Pt 2: Energy in Europe

The Russo-Ukrainian War will cause major changes to the European and global energy system

Be sure to check out Part 1, here

Tl;dr

· Natural gas makes up one-third of Europe’s energy supply, and one-third of that comes from Russia

· The politics surrounding Russian natural gas pipelines go back several decades

· The Russo-Ukrainian War will result in natural gas, crude oil, and diesel fuel price shocks

· The onset of winter will exacerbate these shocks, with implications for the economy, Russian sanctions, and the European Union

· These energy shocks threaten to destabilize European politics

· The US is not immune from these energy shocks

Introduction

In 1940, the Nazi Luftwaffe commenced a massive bombing campaign over Britain known as the Blitz. During nighttime raids, they would attack civilian targets in major metropolitan areas including London. Civilians would gather in the Underground (the subway) for shelter each night. The British public withstood eight months of the Blitz before the British air force was able to repel the Luftwaffe.

Figure 1: Londoners in the Underground during the Blitz

Eight decades later and citizens all over Europe are again preparing for an assault. But this time instead of an enemy air force, the adversary is a winter of restricted energy. Europe gets a significant portion of its energy as natural gas from Russia and due to the war in Ukraine, that gas has been curtailed. Thermostats have been lowered in public buildings, traffic lights are being turned off at night, and natural gas storage facilities are frantically storing as much gas as they can before the onset of winter. How bad it gets depends entirely on the weather. How did Europe get into this position?

European Energy System

As Figure 2 shows, the European Union (EU) energy mix is about one-third oil, one-third natural gas, and one-third other, including nuclear, coal, and renewables.

Figure 2: Energy demand by source in the EU (2017)[i]

Of the natural gas portion, the EU gets around one-third[ii] from pipelines to Russia. Why did the EU become dependent upon their Cold War enemy for energy? It’s been longstanding US foreign policy to advise against this reliance but Russian gas was cheap and made Europe’s economy work, especially in Germany. This geopolitical leverage has been a long time in the making. In the 1970s, Russia’s predecessor the Soviet Union used its intelligence apparatus, the KGB, to assist the European anti-nuclear movement[iii]. The movement made Europe more dependent on natural gas and thus, the Soviet Union.

Figure 3: German anti-nuclear protest

Pipeline Politics

There are several major natural gas pipelines between Russia and Europe. The Nord Stream 1 runs from Russia to Germany under the Baltic Sea. The Nord Stream 1 could carry 55 billion cubic meters of gas per year and was operating at maximum capacity. A parallel Nord Stream 2 of the same capacity was built but never commissioned. The flows in Nord Stream 1 were curtailed to zero in early-September 2022 as leverage by Russia to coax Europe into relaxing its sanctions over the war in Ukraine.

Then in late-September, an unknown saboteur blew up both the Nord Stream 1 and the un-commissioned Nord Stream 2. Their destruction eliminated Russian leverage over Europe, an offramp to the conflict, and will have profound consequences for Europe’s economy.

Figure 4: Russian pipelines to Europe[iv]

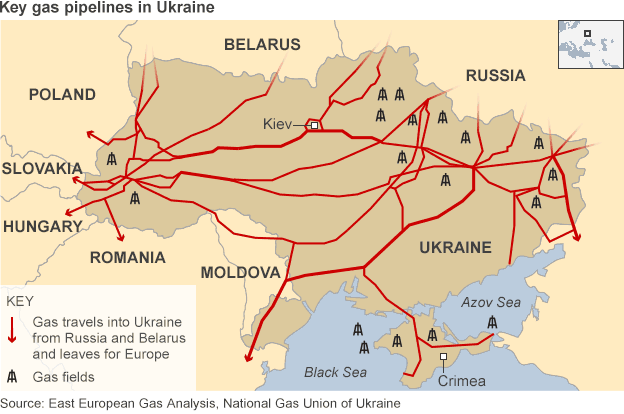

But the majority of Russia-Europe pipeline capacity, two-thirds, transits Ukraine, an active warzone. This gas continues to flow per its commercial obligations[v], but is at risk of Russian curtailment or Ukrainian intervention.

Figure 5: Natural gas pipelines from Russia to Europe through Ukraine[vi]

Energy Shocks

The Russo-Ukrainian War and subsequent Western sanctions on Russia, a major energy exporter, have created several energy supply shocks. These will be felt most acutely by Europe, but will have global reach.

Natural gas

Europe got one-sixth of its energy from Russia in the form of pipeline natural gas. Going forward, Europe has to assume this will go to zero. After the onset of the war, European natural gas prices spiked to as much as 3x their prewar prices.

Figure 6: European natural gas prices[vii]

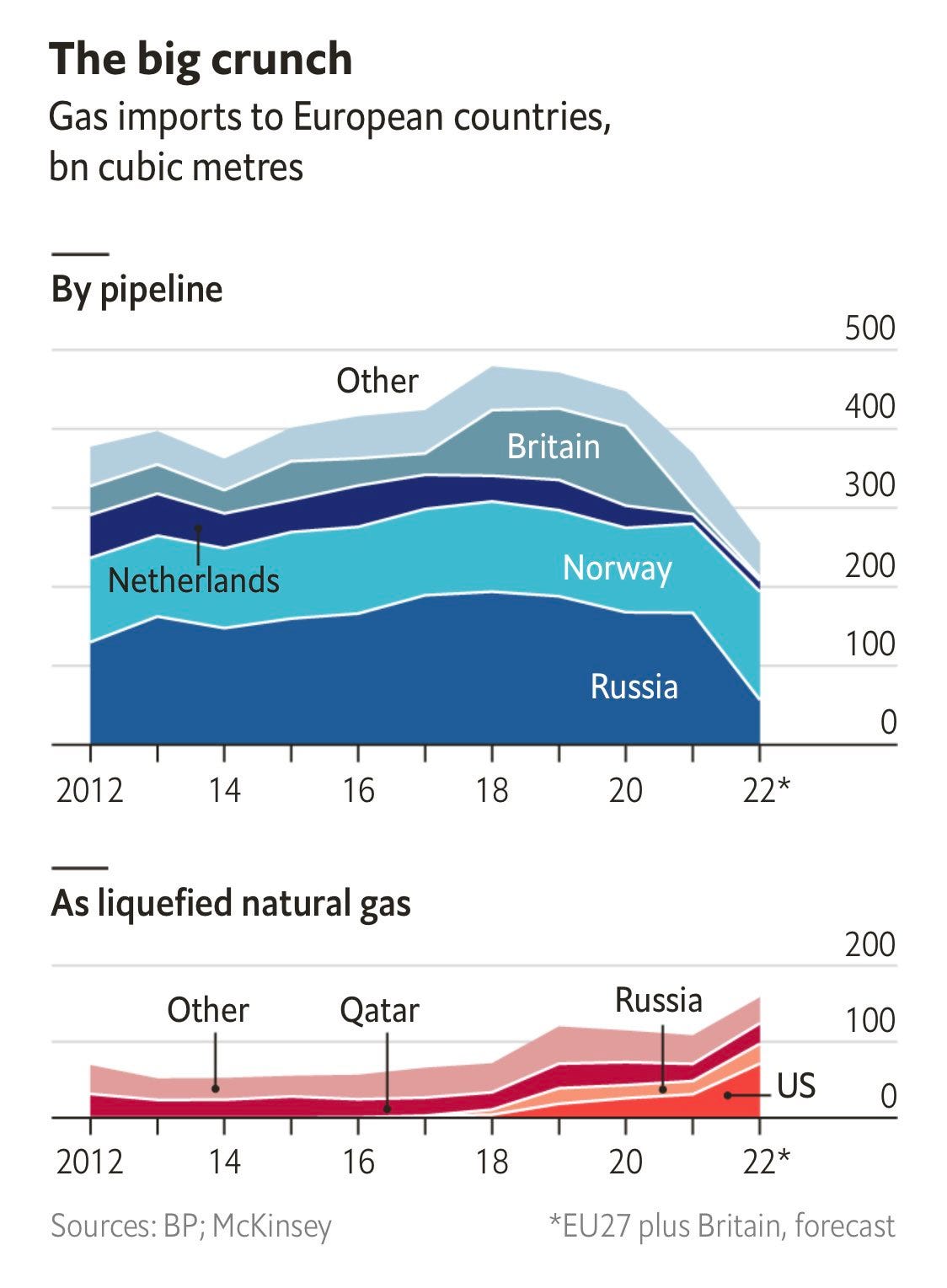

This incentivized the import of Liquified Natural Gas (LNG) from abroad. LNG is natural gas that is chilled to a liquid (-260 F), shrinking it to 1/600th of its gaseous volume so it can be transported by boat. Floating re-gasification equipment has been brought in on barges to receive the LNG. Almost all of this incremental LNG has come from the US.

Figure 7: Gas imports to Europe[viii]

For now, natural gas prices are subsiding and storage facilities are over 90% full[ix], in part thanks to mild weather in October. Europe is better-prepared for winter than many thought possible this summer, but one cold-snap could empty storage, send prices soaring, and risk turning off the heat for millions.

Crude oil

Unlike natural gas, which requires physical infrastructure to market, crude oil is more easily transported at ambient temperature. It can be shipped anywhere via ocean-going supertankers, which can carry as much as 2 million barrels of oil each. Russia exports about 5 million barrels of oil per day[x] and before the war, almost 2 million of those barrels went to Europe. After the war began, about 1 million barrels have been re-routed to Asia, primarily India.

Figure 8: Russian crude oil exports[xi]

Europe plans to ban all Russian oil imports in December and still has a long way to go to get ready. “With less than two months to go before a ban on Russian crude oil imports comes into effect, EU countries have yet to diversify more than half of their pre-war import levels away from Russia,” the IEA said in its Oil Market Report in October.[xii] The effect of this ban, on Europe and Russian exports, is unclear. But the risk to the global oil market skews to higher prices.

There are two additional risks going forward, each of which could cause oil prices to spike. The first is that some portion of the 5 million barrels Russia exports go offline. A significant portion of oil exports leave from ports in the Baltic and Black Seas in western Russia. The oil fields feeding those ports cannot be re-routed and if anything were to happen to the infrastructure (a naval blockade, sabotage, etc.), that oil would be stranded. Another possibility is Russian oil companies aren’t technically proficient enough to pump their own oil. Western firms are usually the most capable but they have left Russia since the war began. Without Western assistance, Russia’s oil exports could dwindle over time.

The second is that Putin uses oil as a weapon and cuts off exports. This could cause oil prices globally to quadruple and was previously discussed by Ad Astra. This scenario is unlikely because it would deprive income to the Russian state, but is probably more likely than Putin using nuclear weapons.

Diesel

The final major shock comes further down the energy value chain: diesel fuel. Refineries purchase crude oil and process it into commercial diesel that goes into trucks, combine tractors, and other machines that power the modern economy. Two things are happening in Europe: a significant amount of refining capacity is offline and the EU plans to ban the import of diesel refined in Russian refineries in February 2023[xiii].

In Europe, maintenance and strikes of French refinery workers have taken a huge amount of refining capacity offline. In October, around 1.5 million barrels per day (bpd) of refining capacity was offline in Europe for planned and unplanned maintenance[xiv]. Strikes in France have taken 740,000 bpd – or 60% of the country’s capacity – offline.[xv] This means Europe lacks the capacity to turn raw crude oil into a usable commercial product. This comes at the worst possible time as Europe plans to ban Russian diesel imports.

As a part of the Western sanctions regime against Russia, the EU plans to ban the import of Russian diesel fuel in February 2023. Before the war, Europe imported just over 500,000 bpd from Russia. As of October 2022, they have yet to significantly diversify away from Russian diesel imports (Figure 9). Expect shortages in February 2023.

Figure 9: Russian diesel exports to Europe

Winter is Coming

Colder weather is approaching, and Europe’s fate rests with mother nature. If the weather is mild, less energy will be needed. If the weather is especially cold, Europe’s natural gas, crude oil, and diesel problems will be worse. Moreover, sanctions on Russia only work if everyone sticks together. As rising energy prices inflict pain on citizens, they will put pressure on their governments to end sanctions. Most analysts are cautiously optimistic about this winter. Many are more concerned about the winter of 2023-24 if the war is still going on.

Predicting the future, especially during a war, is a fool’s errand. But at Ad Astra we see four possible scenarios, all of which entail the Eurozone economy tipping into an energy shock-induced recession:

1. The EU cooperates on sanctions and winter is mild

In the best possible scenario, the weather cooperates and there is only a mild, regional recession. Collective sanctions on Russia stay in place.

2. EU members diverge on sanctions and winter is mild

Sanctions on Russia will fall apart and cease to be effective.

3. The EU cooperates on sanctions and winter is severe

The energy shock is so severe that it tips the world into recession, but the sanctions on Russia remain effective.

4. EU members diverge on sanctions and winter is severe

In this worse-case scenario, the energy shock is so severe and some countries relax sanctions while others fight to maintain them until the European Union itself dissolves.

Figure 10: Scenarios for winter in Europe

Political Repercussions

The Yellow Vests Protests were a movement in France in 2018 against rising fuel prices and taxes, the cost of living, and inequality. They got their name from the uniform of transit workers: the high-visibility yellow vest. They resulted in several government policy changes, including the repeal of a new fuel tax and the freezing of state-controlled electricity prices.

Figure 11: French Yellow Vests Protests in 2018

The potential energy price shocks in 2022 are far greater than those in 2018, and affect the entire continent of Europe. Inflation in the Eurozone is in the double-digits and continues to rise.

Figure 12: Inflation in Europe[xvi]

Populist, nationalist movements are already on the rise in Europe and the situation in Ukraine could supercharge them. EU members relaxing sanctions could undermine their effectiveness against Russia. The urge for the government to subsidize rising energy prices could rattle bond markets and lead to sovereign debt crises that threaten the EU. Putin is likely betting on the break-up of sanctions and it’s not a bad bet.

This is not hypothetical. Governments in Europe have already begun to fall (though with no major Ukraine policy changes). Two Prime Ministers have fallen in the UK (though for ostensibly different reasons). Italy elected a Eurosceptic from the nationalist Brothers of Italy. The Swedish Democrats, a nationalist party, took a record number of seats and the majority in the Swedish parliamentary elections. This is all before winter strikes.

The Ex-Colony

Across the Atlantic, the United States is not immune to these energy shocks. That will be the topic of Part 3 of the Gathering Storm.

Figure 13: American oil refinery

[i] González, Liliana & Canepa, José. (2017). Biomass as an Alternative for Gas Production. 10.5772/67952.

[ii] WTO

[iii] https://warontherocks.com/2017/09/russian-active-measures-in-germany-and-the-united-states-analog-lessons-from-the-cold-war/

[iv] https://www.euractiv.com/section/energy/opinion/what-if-nord-stream-2-is-never-completed/

[v] https://tsoua.com/en/news/despite-the-war-gtsou-ensures-fulfilling-its-obligations-before-clients/

[vi] https://www.resilience.org/stories/2014-03-07/ukraine-crisis-is-about-great-power-oil-gas-pipeline-rivalry/

[vii] Financial Times

[viii] The Economist

[ix] https://www.barrons.com/news/gas-crisis-fears-recede-for-now-as-europe-stockpiles-01667214309?refsec=topics_afp-news

[x] https://www.eia.gov/todayinenergy/detail.php?id=33732

[xi] The Economist

[xii] https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Production-Down-In-October-And-Set-To-Fall-Further.html

[xiii] https://www.bloomberg.com/news/articles/2022-10-26/europe-risks-diesel-supply-shock-as-russia-oil-sanctions-near

[xiv] https://www.zawya.com/en/world/uk-and-europe/europe-braces-for-heavy-oil-refinery-outages-amid-tight-supplies-vr17p0zf

[xv] https://www.reuters.com/business/energy/french-strikes-delay-price-recovery-crude-grades-europe-2022-10-20/

[xvi] Wall Street Journal