There’s a populist bomb waiting to go off at the Federal Reserve

When it goes off, voters on both the left and the right will be outraged

SUBSCRIBE HERE

Author’s note: the American Economy series will resume next post

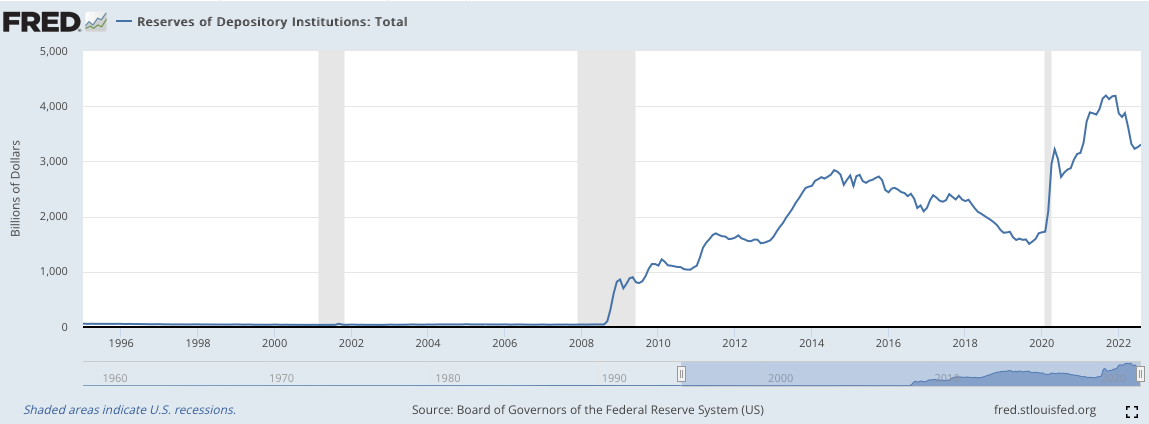

As emphasized in Legacy of the Great Recession, our world today is heavily influenced by the Global Financial Crisis (GFC) of 2008. One of the legacies of the crisis is that banks are required to hold excess cash reserves in order to lessen the risk of a similar GFC-style bank run in the future. Banks can either keep the excess cash in their own vaults or at the Federal Reserve (the Fed). If they keep the money at the Fed, interest will be paid on it like your personal bank account. Unlike your personal bank account, banks have accumulated more than $3 trillion there since 2008.

Figure 1: The Fed's $3 trillion pile of cash

Over the past decade+, the interest payments to banks have been negligible because interest rates have been near-zero. But to control recent inflation, the Fed has been aggressively raising rates to put a brake on the economy. The rate is currently 3.25% and is expected to be 4.6% in 2023.[i] The interest being paid to banks will soon to be not-so-negligible. At 4.6% interest, that’s $138 billion in interest on $3 trillion paid to banks from taxpayer money. To put that in perspective, its

15 billion in payments just to, say, JP Morgan Chase, or more than 10% of the bank’s expected $129 billion in revenue this year.[ii]

At the same time, Federal Reserve officials have been telling people to expect higher unemployment in 2023 as a result of their interest rate hikes to reduce inflation. “Our expectation is that we might see more unemployment in 2023 than we've seen in 2022, and that's part of cooling down the economy and helping to bring inflation back down to that target range” said Minneapolis Fed representative Abigail Wozniak.[iii] Equally disconcerting, Jamie Dimon, CEO of JP Morgan Chase, testified in front of Congress last week and told policymakers to “be prepared for the worst” as the Fed hikes rates.

So the people who blew up the global financial system in 2008, the ones who caused a decade of 0% interest rates and our current predicament, many of whom are millionaires or billionaires, are about to get billions from taxpayers. Meanwhile, those taxpayers are going to get laid off, suffer through 40-year high inflation, and otherwise face some of the worst economic conditions since the Great Depression.

Figure 2: JP Morgan Chase CEO Jamie Dimon tells us to prepare for the worst

I’m not a banker hater. I have lots of friends in finance, and America needs Wall Street to work. I’ve even met Jamie Dimon, he’s a nice guy. But even he’ll admit the current situation is a bad look. And the upcoming political backlash is going to be severe.

As Mr. T always says, “I pity the fool who drops interest rates to zero for a decade”

SUBSCRIBE HERE

[i] Federal Reserve

[ii] TK News

[iii] CBS Minneapolis