The American economy: Introduction

This fall, Ad Astra is doing a multipart series on the US economy

Authors note: Over the next several months, Ad Astra is doing a multipart series on the US economy. The objective is to cover a complex topic in plain English and by the end, leave the reader with an understanding of the biggest challenges facing the US in the 2020s.

Tl;dr

·Inequality, deindustrialization, monopolization, higher education and COVID-19 are the topics this series will cover

·The Great Recession in 2008 increased wealth inequality to levels last seen before the Great Depression

·Deindustrialization in the US has led to manufacturing employment falling dramatically

·Monopolies rule the American economy

·The cost of higher education in America has increased by 1200%, versus 280% for everything else, since 1980

·The economic response to COVID-19 exacerbated all of these trends

·Bright spots in the US economy include achieving energy independence and reducing CO2 emissions to pre-1990 levels

Occupy Wall Street

In 2011, as a Senior at the University of Kansas, I found myself on a trip to New York City to attend an economics conference. In 2008, the Global Financial System blew up and ever since, the natives had been restless. A protest had been set up near Wall Street, the global financial capital, in Zuccotti Park called Occupy Wall Street. The protesters sought to draw attention to widening wealth inequality, a symptom of the financial crisis. Their rallying cry was “we are the 99%”, a reference to the vast majority of people versus the 1% elite with vast, and growing, wealth.

The conference I was attending wasn’t far from Zuccotti Park and the protest had gained widespread media coverage, so I decided to stop by to see what all the fuss was about. There, I found a tent city and lots of grimy protesters. There was drug paraphilia on the ground and a faint wisp of human excrement in the air. At the time, it was easy to dismiss as a den of crazies. But a decade later after populism has roiled both sides of the political aisle in America and a gig-economy underclass has begun to form, maybe they were on to something.

Figure 1: Your humble author at Occupy Wall Street in NYC, 2011

Inequality

Inequality has always been a feature of American life, but current levels are the highest they’ve been in a century, equivalent to immediately before the Great Depression. To combat the Global Financial Crisis (GFC) in 2008, the US federal government undertook policies that benefited those who owned assets (like stocks). Meanwhile, regular people who live paycheck to paycheck or store their earnings in savings accounts have seen their wealth stagnate. Since the GFC, the bottom 50% of income earners have gained nearly zero wealth while the top 1% has added more than $20 trillion.

Figure 2: Wealth inequality since 2008[i]

The top 0.1% holds roughly the same amount of wealth as the bottom 90%. No matter how you slice the numbers, its bad. Besides it being antithetical to the American Dream, history shows us that rising inequality precedes all sorts of bad things like civil unrest, political violence, war, depressions, and a parade of other horrible events[ii]. It’s a feature of the American economy that must be addressed if we want a tranquil 21stcentury.

Deindustrialization

A common narrative is good, middle-class manufacturing jobs got sucked out of the US after China joined the World Trade Organization (WTO) in 2000. And that’s true. Or that robots replaced human manufacturing workers. Also true. But the whole truth is that the share of manufacturing jobs in the US has been falling since the 1950s.

Figure 3: Manufacturing jobs in the US[iii]

The US used to be a global manufacturing powerhouse. It’s how the industrial North beat the agrarian South in the US Civil War. It was the same “Arsenal of Democracy” that armed the Allies and was back-to-back world war champions. But today, the US economy is made up largely of service industries. We got a taste of our exposure during the COVID-19 pandemic, when we realized we no longer made ventilators or basic medical PPE. We are constantly reminded today when goods we used to make but now import are delayed by “supply chain issues”.

Deindustrialization isn’t just an economic issue, it’s social crisis. Deaths of Despair (suicide, alcohol-related, or drug overdose) are up in the United States, particularly in areas hit hard by deindustrialization. The opioid epidemic flourished in areas where manufacturing jobs left (this book and this documentary cover the epidemic in detail). It’s gotten so bad that life spans in America have started to decrease for the first time in history. The issue has made our politics unreconcilable and is a massive sore on the US economy.

Figure 4: Deaths of Despair in the US[iv]

Monopolization

In the 1970s, the US economy was in bad shape. Recession and inflation (a combination called stagflation) caused widespread economic hardship. Politicians sought any solution to restore economic prosperity. They settled on deregulation and privatization, which was applied liberally on a bipartisan basis for the next three decades. It worked, up until the 2008 GFC, which was arguably caused by those policies.

But there was a sinister side-effect of all that deregulation: the rise of market concentration across almost all industries. The government had the power to regulate mergers between firms but rarely did so. The logic was that bigger firms had more economies of scale and could reduce costs for consumers. But when there were only a few firms left in a given industry, they could collude and gained tremendous pricing power over consumers.

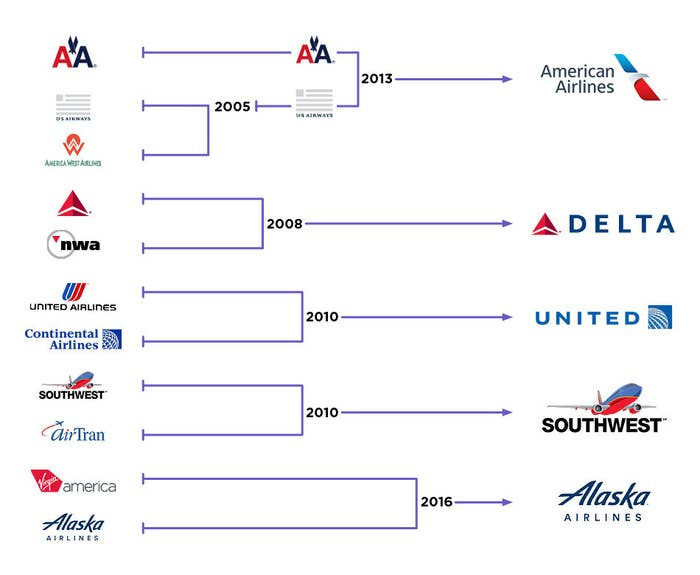

Figure 5: Market concentration in the airline industry[v]

Today, American consumers face monopolies wherever they turn. There are only five major domestic airlines. We get our meat from four meatpackers. Five publishers control all books in America (potentially soon to be four). The media is controlled by five mega-firms. Baby formula is mostly made by three companies, which turns out to be too few. And in the 1990-2000s, several firms based on the internet (a recent invention) became Big Tech, an information monopoly unlike anything in the history of the country.

Figure 6: Market concentration in the media industry[vi]

Monopolies have rigged the American economy, raised prices for consumers and stifled innovation. They exert excessive influence on our democratic process and must be brought to heel in a fair, prosperous American economy.

Higher Education

At the heart of the American economy is the biggest scam of all: college. To get many jobs, you need a four-year degree; better yet a graduate degree. To get these degrees, students spend money they don’t have and sit through many courses they arguably don’t need. After spending 6+ years earning their credential (a BA, MBA, RN, PA, MD, CPA, PhD, etc, etc), young workers enter the economy with crushing levels of student debt that they may never escape from.

From 1980 until today, the cost of higher education has increased 1200% versus just 280% for consumer inflation.

Figure 7: The cost of higher education in America

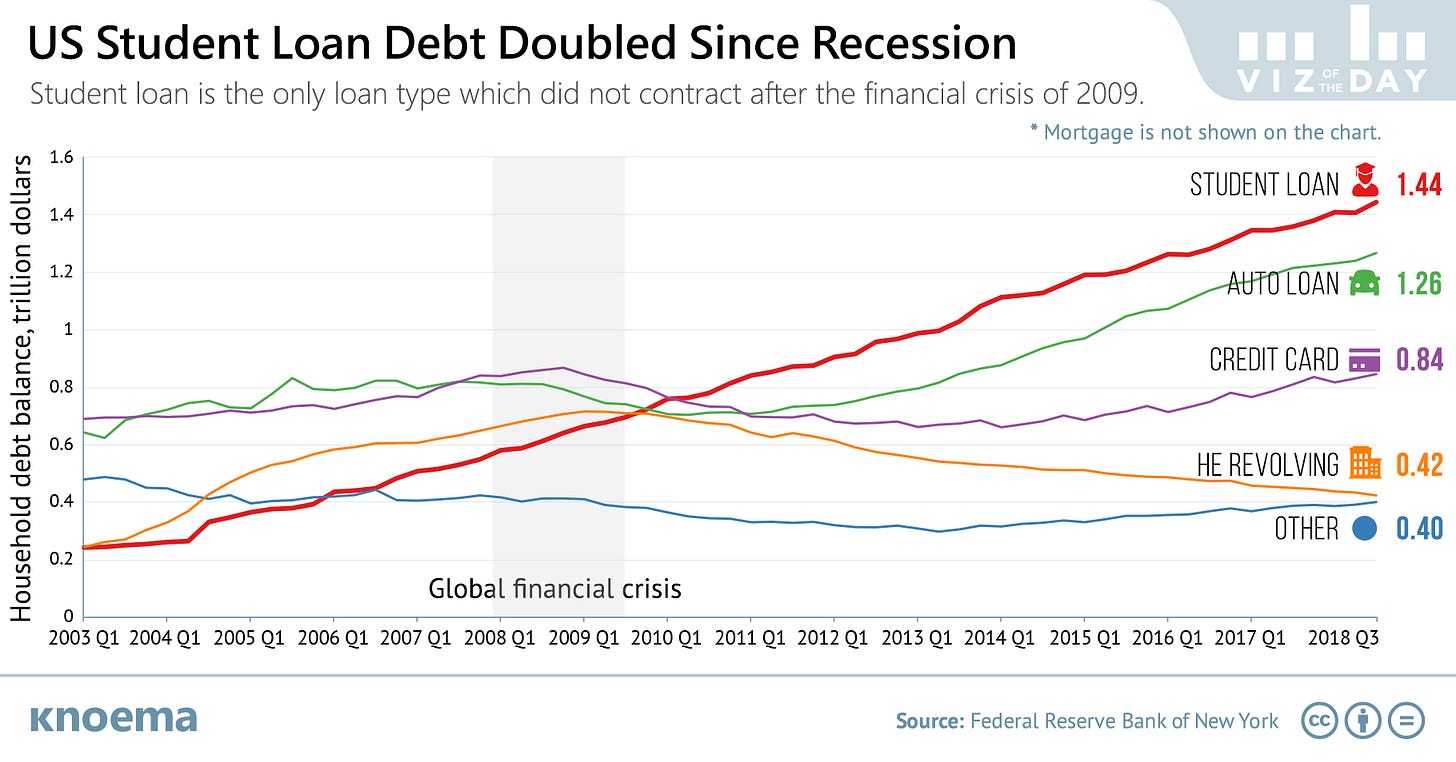

Outstanding student loans surpassed auto loans, credit card debt, and all other debt at nearly $2 trillion, and have increased significantly after the GFC. It’s gotten to the point where you have to have money to go to college, which means you have to have money to get a good job, creating a permanent aristocracy and underclass. This decline in class mobility is nothing less than the Death of the American Dream, the notion that you can be better off than your parents if you work hard.

Figure 8: Growth of student loan debt[vii]

COVID-19

The economic response to the COVID-19 pandemic would have stressed a robust, healthy economy. The US economy was not a robust, healthy economy before the pandemic. Instead, the effect was like pouring gasoline onto a burning dumpster fire. There are two levers the federal government has to affect the economy: fiscal policy and monetary policy. Fiscal policy is money authorized by Congress. Monetary policy is carried out by a less well known but very powerful institution called the Federal Reserve.

Congress spent more than $5 trillion on COVID-19. For comparison, the US spent $4.7 trillion in current dollars on WW2[viii]. Two major stand-alone stimulus bills were passed, the CARES Act in March 2020 ($2.3 trillion) and the American Rescue Plan Act in March 2021 ($1.9 trillion). Several supplemental bills were also passed, including a $900 billion effort in December 2020 that was bigger than the stimulus passed after the GFC. There is no doubt that some of this spending was necessary, but we are just beginning to learn the extent of what some are calling “the greatest fraud in US history”[ix]. In a preview of a major story over the next several years, as much as $80 billion of the Paycheck Protection Plan’s funding was shown to be fraudulently siphoned off to buy Ferraris, mansions, and even private jets.

But the fraudulent waste of taxpayer dollars pales in comparison to the distorting effect that the monetary policy carried out by the Federal Reserve (the Fed) had on the American economy. The Fed has two primary ways to throttle the economy: interest rates and quantitative easing. Interest rates are sort of like the radioactive rods Homer Simpson controls at the nuclear power plant. Lower them and reaction speeds up, raise them and the reaction slows down. Keep them too low for too long and there’s a meltdown. Likewise, lowering interest rates speeds up the economy (a good response to an economic slowdown), raising them slows down the economy, and keeping them too low for too long causes inflation.

Figure 9: The Fed controlling the US economy

In March 2020, the Fed cut interest rates to 0%. This had the effect of incentivizing people to borrow money. Think about your own life: a home mortgage at 3% makes a house much more affordable than a mortgage at 6%. Now extrapolate that millions of times to the entire economy. The price of homes skyrocketed, as mortgages became more attractive. Companies took out cheap loans to buyback their stock, creating a massive stock market bubble. This benefitted the owners of assets, significantly worsening inequality. Mergers and acquisitions fueled by cheap debt took off, making an already bad monopoly problem even worse.

Quantitative easing is a euphemism for printing money. Over the course of the pandemic, the Fed created $5 trillion. In 2020, 1 out of every 5 dollars in circulation was created that year. M2 is Fed jargon for the money supply. In response to this crisis, the Fed grew M2 by more than any other time in its century-plus history. We are now experiencing a hangover from this monetary binge in the form of 40-year high inflation (made worse by an energy crisis, which I discuss here).

Figure 10: Growth of M2 over last 50 years[x]

Energy and the environment

Everything mentioned so far in the recent history of the American economy has been bad, but there are bright spots (though you wouldn’t know it). In the early 21st century, America unlocked multiple Saudi Arabia’s worth of oil and gas by virtue of hydraulic fracturing and made itself energy independent. This will have profound geopolitical consequences in the coming decades, as security involvement in the Middle East becomes unnecessary. It will also lower domestic electricity costs (cheap fuel means cheap electricity) making US manufacturing among the most competitive in the world, reversing deindustrialization.

Figure 11: US oil and gas production in the 21st century[xi]

The use of cheap, clean burning natural gas in lieu of coal has helped reduce CO2 emissions to pre-1990 levels. The reduction from their peak in the early 2000s is roughly one-third coal-to-gas electricity generation switching, one-third efficiency improvements, and one-third green tech (windmills, solar, etc.)[xii].

Figure 12: US CO2 emissions over the last 50 years[xiii]

Up Next

Thanks for reading the introduction to this multipart series on the American economy. Up next is the Legacy of the Great Recession.

[i] New York Times

[ii] Dalio, Ray. The Changing World Order. Simon & Schuster, 2021.

[iii] BLS

[iv] CDC

[v] Buzzfeed

[vi] Wall Street Journal

[vii] New York Federal Reserve

[viii] https://www.nasdaq.com/articles/money-printing-and-inflation%3A-covid-cryptocurrencies-and-more

[ix] https://www.nbcnews.com/politics/justice-department/biggest-fraud-generation-looting-covid-relief-program-known-ppp-n1279664

[x] BLS

[xi] EIA

[xii] https://www.hbs.edu/competitiveness/Documents/america-unconventional-energy-opportunity.pdf

[xiii] EIA

Greg, the analogies that you used in this article to bring esoteric topics to levels of mass understanding were superb! You have a gift for explaining enigmatic subjects with clarity and comprehension.

Well done, Greg! Very informative and great food for thought.

With the current tightening monetary policy but loose fiscal policy, where do you think the economy is headed next?

Who is to blame for (and to fix) the student loan crisis? Universities that have increased the cost of higher education? Students who requested debt that will end up being a poor investment? Lenders for offering the debt to those who will have a hard time repaying? Government for lack of regulation?

How do you think global supply chains will recover going forward? Will China remain a pillar of global supply chains? If there is re-structuring of supply chains, what will that look like? Will manufacturing jobs come back to the US?