The Plague Economy

Part 6 of the US economy series focuses on the major effects of the COVID-19 pandemic and government response on the US economy

Don’t miss Part 1: Introduction

Part 2: Legacy of the Great Recession

Part 4: Welcome to the New Gilded Age (monopolies)

Part 5: American Aristocracy (higher education)

Tl;dr

· The COVID-19 pandemic had an economic effect equivalent to a world war on the US economy

· Congress spent $6 trillion on pandemic relief

· The Federal Reserve’s actions in response to the pandemic distorted many markets

· Specifically, asset bubbles were created in the stock market, the housing market and corporate mergers boomed

· Significant consequences from the pandemic included inflation, inequality, rising debt, reshored supply chains, and technological acceleration

US President Woodrow Wilson was in Paris and confined to his hotel room with the Spanish Flu.[i] The year was 1919 and an influenza pandemic had been raging since 1917. It played a part in Germany’s defeat in WW1 and had reshaped the global economy for a dark Interwar Period that would include the Great Depression and culminate in WW2. In Paris, President Wilson would negotiate the Treaties of Paris, the formal end to WW1, which most historians today agree sowed the seeds for WW2.

Pandemics have occurred periodically throughout human history. They typically change the economy and alter the course of history. Those with a Darwinian view of the world see them as nature’s way of rebalancing populations. Those with a Humanistic view of the world see them as unlocking latent creativity and progress. The Black Death, one of the worst pandemics in history, was followed by the Renaissance, one of the most progressive eras in history. There’s probably some truth to both views of the world. The COVID-19 pandemic was no different and will alter the future in ways impossible to predict. COVID-19 and the government’s response to it have radically reshaped the US economy.

An unusual feature of the recent past is that in 2020 a pandemic had the fiscal and monetary consequences of a world war. This was unprecedented. No previous pandemic, including the much more devastating 1918-19 influenza, had elicited comparable responses from finance ministries and central banks.[ii]

This post will focus on how “finance ministries” (e.g. Congress and the government bureaucracy in America’s case) and “central banks” (e.g. the Federal Reserve) responded to the crisis and how the economy was reshaped.

Congressional Response

Once the global scope and severity of COVID-19 became clear, Congress wasted no time passing massive relief packages for the American people:

Congress passed several pieces of legislation in response to the 2020 pandemic to provide financial assistance to individuals and businesses. The CARES Act (Coronavirus Aid, Relief, and Economic Security Act) in March 2020, which provided $2.2 trillion of funding. The Paycheck Protection Program and Health Care Enhancement Act in April 2020, which provided an additional $484 billion for small business loans and funding for hospitals and testing. The Families First Coronavirus Response Act in March 2020, which provided paid sick leave and expanded family and medical leave for certain employees affected by the pandemic. The Consolidated Appropriations Act, 2021 in December 2020, which provided another round of stimulus payments, extended unemployment benefits, provided funding for vaccine distribution, and provided funding for other programs and initiatives related to the pandemic with an approximate of $900 billion. The most recent stimulus package, the American Rescue Plan Act of 2021 (ARPA) passed on March 2021, is a $1.9 trillion package of spending and tax breaks aimed at providing economic relief to individuals and businesses affected by the ongoing COVID-19 pandemic.[iii]

For those of you keeping track at home, the federal government spent $6 trillion[iv] and counting responding to the pandemic, all of which has been added to the federal debt. Total federal debt stands at $31 trillion, equivalent to levels after WW2 on a percentage basis.

Figure 1: US federal debt as percentage of GDP[v]

Federal Reserve Response

The Federal Reserve also took dramatic action to support the economy at the pandemic’s onset:

The Federal Reserve took several actions in response to the economic impacts of the 2020 pandemic. These actions included: Lowering the target range for the federal funds rate to near zero, launching several lending facilities to support credit markets and specific sectors of the economy, purchasing Treasury bonds and mortgage-backed securities to help keep borrowing costs low for households and businesses, encouraging banks to lend to customers affected by the pandemic, providing guidance and support to help financial institutions continue to provide credit to households and businesses, collaborating with other government agencies and central banks on global response to the pandemic. The Federal Reserve also announced that it would continue to use its full range of tools to support the economy for as long as it takes to ensure that inflation and employment return to their pre-crisis levels.[vi]

As noted before, this action was no different than printing money. In fact, the Fed printed more money in a month than in two centuries of American history.

Figure 2: US money supply[vii]

Market Response

The massive intervention in the economy distorted many markets but Ad Astra will highlight three.

1. Stock market

The infusion of easy money caused the stock market to recoup its initial March 2020 losses and then inflate a massive asset bubble. That bubble deflated over 2022 and as of early 2023, its unclear which direction the stock market will head.

Figure 3: S&P 500 (2011-present)[viii]

2. Mergers and acquisitions (M&A)

Easy money meant taking out loans was cheap. Corporations took on debt to buy competitors, exacerbating the corporate concentration problems highlighted in Welcome to the New Gilded Age. Overall, mergers in the economy boomed and monopolies became an even bigger problem.

Figure 4: US M&A activity[ix]

3. Housing market

COVID-19 profoundly affected the US housing market in two ways. First, low interest rates made mortgages inexpensive, boosting home sales and prices. Second, more fundamentally Zoom teleconferences and working from home let people (white collar employees) work from anywhere. People left major cities and the coasts to relocate to 2nd tier cities in the US interior. Urban cores withered and less expensive locations boomed. As of this writing its clear this will be a multi-year trend but uncertain how this new geography will affect life in the US.

Figure 5: Rent across the US[x]

These distortions had major consequences for the US and global economy.

Consequence 1: Inflation

Shutting down the global economy and the government’s massive stimulus programs caused forty-year high inflation in the US from 2021-present. Turning off the supply of lumber, oil, automobiles, and other items caused them to be in short supply when the economy reopened. Wages increased as the price of everything rose and a labor shortage strengthened union negotiators, creating a rising cost feedback loop that further stoking inflation. Rising home prices and elevated rents, further exacerbated price levels. As of this writing, it appears inflation has peaked in the US but it is still elevated relative to the past several decades.

Figure 6: US inflation[xi]

Consequence 2: Inequality

The US was already very unequal before the pandemic, at levels last seen before the Great Depression. But the Federal Reserve’s response to COVID-19 supercharged inequality. The dropping of interest rates to zero caused all assets – stocks, bonds, real estate, other real assets – to skyrocket. Since mostly rich people owned these assets, gains were not evenly distributed across society. Factoring in that inflation disproportionally harms people of lower income, the pandemic melon scooped an already hollowed out US class structure.

Figure 7: US inequality[xii]

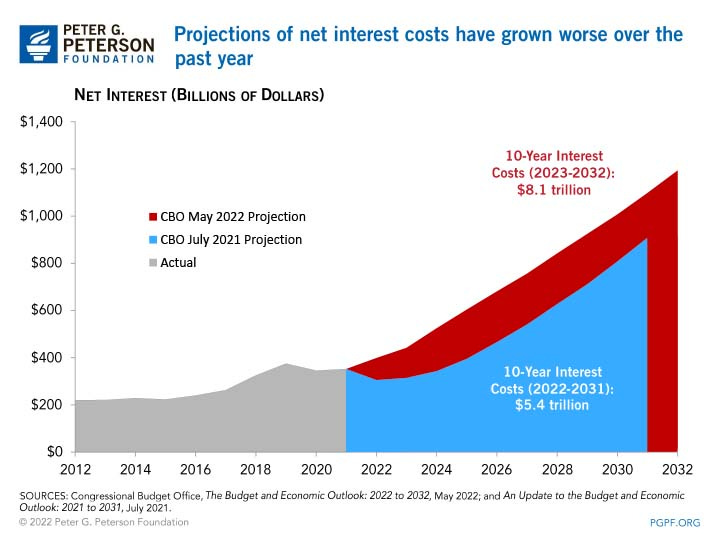

Consequence 3: Increased Debt

In fifty years when historians look back at this period they won’t talk about vaccines or classified documents, they’ll talk about how the pandemic wrecked this countries’ finances. Everyone with a mortgage understands how higher interest rates increase monthly payments. The same is true for a country budget. The US both took on additional debt to stimulate the economy - $6 trillion – and raised interest rates to combat inflation. The result is a sharp rise in interest payments in the coming years. The increase is so steep that after nondiscretionary spending on Social Security and Medicare, there won’t be much room in the federal budget after debt service payments. Expect a big fight over the debt ceiling between Democrats and Republicans in 2023.

Figure 8: US federal budget interest expenses[xiii]

Consequence 4: Reshoring Supply Chains

When the pandemic hit and Americans ran out of masks and other PPE, it became clear to everyone that hyper-globalized, just-in-time supply chains had made this country vulnerable. Making things in America, even if they cost a little more, provided security of supply. In other cases, removing the shipping cost of things made an ocean away and instead manufacturing them near their point of consumption made economic sense. Layering in rising geopolitical tensions, especially in the US-China New Cold War and the Russo-Ukrainian conflict, and many corporations are relocating their supply chain to America. The terms “reshoring”, “friendshoring”, and “nearshoring” have skyrocketed in recent corporate earnings calls.

Figure 9: Rise in corporate bosses mentioning reshoring supply chains in earnings calls[xiv]

Consequence 5: Technological Acceleration

The COVID-19 pandemic catapulted the world forward technologically one decade. The geography of work was reshaped with Zoom meetings. Will work travel ever fully recover? Will offices in city centers ever be viable again? QR codes in lieu of menus are commonplace at restaurants, as is ordering fast food ahead from your smartphone. Even your Boomer parents are embracing ecommerce and ordering curbside from the big box store. The rapid rollout of mRNA vaccines has turbocharged the biotech sector. In many cases, these tech-enabled adaptations are better, faster, and cheaper than the old way of doing things. Better yet, it has recalibrated the population’s expectations about what tech can do. Technological innovation may be the lasting legacy of the COVID-19 pandemic.

Figure 10: Explosion of data stored in the cloud[xv]

Up Next

In the seventh and final installment of the US economy series, Ad Astra will explore the economic dimensions of the failing US healthcare system, before turning to solutions.

[i] Kahl, Colin, and Thomas J. Wright. Aftershocks: Pandemic Politics and the End of the Old International Order. St. Martin's Press, 2021.

[ii] https://www.bloomberg.com/opinion/articles/2022-10-23/cold-war-2-with-china-and-russia-is-becoming-ww3-niall-ferguson

[iii] ChatGPT

[iv] ChatGPT

[v] https://www.cbo.gov/publication/56516

[vi] ChatGPT

[vii] St. Louis Fed

[viii] www.yahoo.com

[ix] https://www.whitecase.com/insight-our-thinking/us-ma-h1-2022-us-settles-back-down

[x] The Economist

[xi] BLS

[xii] New York Times

[xiii] CBO

[xiv] Goldman Sachs

[xv] https://www.zippia.com/advice/big-data-statistics/

![26 Stunning Big Data Statistics [2023]: Market Size, Trends, And Facts – Zippia 26 Stunning Big Data Statistics [2023]: Market Size, Trends, And Facts – Zippia](https://substackcdn.com/image/fetch/$s_!HfuT!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F6754b9f6-b745-4e2f-8538-2a038eff6932_800x667.jpeg)