How To Fix Banks, Inflation, And The Economy Part 3: Stock Buybacks

To move beyond financial engineering on Wall Street and to reignite growth on Main Street, we must ban stock buybacks

Tl;dr

· This post discusses the harmful effects of stock buybacks

· Stock buybacks are when a company repurchases its own stock to increase the value

· Stock buybacks boomed in the twenty-first century

· The harms of stock buybacks include increasing inequality and decreasing innovation

· The American defense industrial base cannot produce enough munition to meet US objectives in Ukraine and Taiwan, partly due to splurging on stock buybacks

· Warren Buffet likes stock buybacks. He is wrong.

General Electric (GE) was founded in the first Gilded Age by Thomas Edison. Over the next century-plus, the industrial conglomerate became an innovation juggernaut (two of its employees won the Nobel Prize) and even began to define American Capitalism itself. Then like Icarus, it spectacularly imploded in the second decade of the twenty-first century. Straying from its historical legacy of inventing cutting-edge products like jet-engines and MRIs, it developed a sprawling financial services arm and between 2010-2016 plowed $50 billion into stock buybacks[i]. Stock buybacks are a financial engineering trick to increase one’s own stock while starving spending on productive things, like research and development.

In this series, Ad Astra has shown several examples where financiers on Wall Street have undermined prosperity on Main Street.

1. In Part 1: Banks, we looked at the recent history of finance and ways to strengthen banks

2. In Part 2: Inflation, we examined how Great Depression levels of non-participation in the economy, including the people who never returned to the workforce after COVID-19, is fueling inflation

3. In Part 3: Stock Buybacks, this post, we’ll conclude by exploring how banning stock buybacks would be one simple way to reverse the financialization of our economy

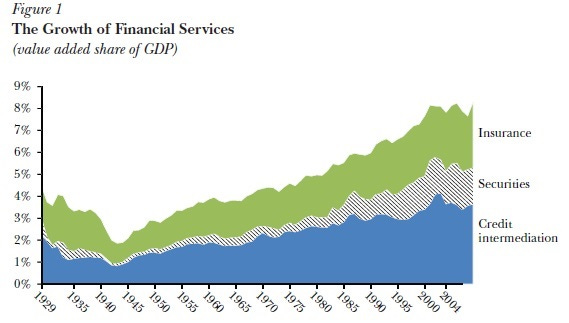

During WW2, the height of US manufacturing power, the share of the economy devoted to finance and insurance was 2%. By 2021, it had quadrupled to 8%[ii]. As finance grew in relative importance, financial engineering became more prestigious than actual engineering. Among the many inventions of financial engineers were stock buybacks.

Figure 1: Share of the US economy devoted to financial services[iii]

What Are Stock Buybacks?

The primary judgement of a firm’s profitability, and the main compensation of its executives, is its stock price. A firm issues shares to the public, which entitle an investor to a fraction of ownership in the corporation. The number of shares issued in total is its shares outstanding.

The profit produced by a firm selling a product or service is its revenue less the cost of goods sold, tax, and other expenses. Sometimes complex accounting rules govern this calculation and can vary by industry. Income is the figure that ultimately approximates profitability, is an accounting standard, and can be used to compare businesses, even across industries.

Earnings per share (EPS) are a firm’s income divided by its shares outstanding. If a hypothetical Acme Inc. makes $1 million in income and has 1 million shares outstanding, its EPS is $1.00 ($1 million / 1 million shares). Executives are often compensated with EPS targets (i.e. if you exceed x EPS, you get y bonus).

A stock buyback is when a firm buys some of its shares outstanding. In the example above, let’s say that Acme Inc. buys back 100,000 of its shares. Now its EPS is $1.11 ($1 million / 900,000 shares). Acme Inc. improved its EPS without providing any additional value to society.

Here is a short video explaining stock buybacks:

The New Gilded Age

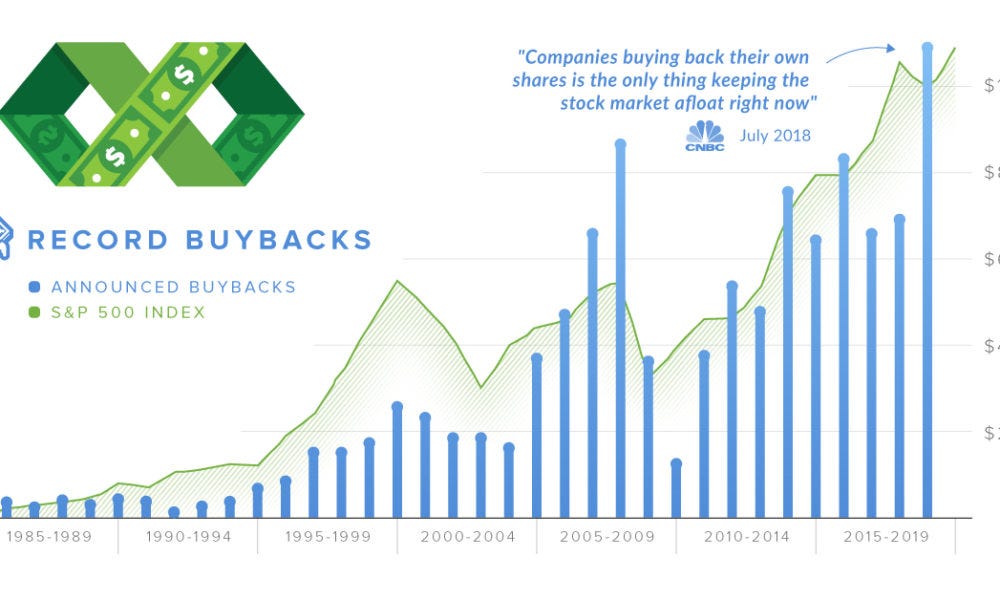

Share buybacks became extremely fashionable in the twenty-first century. Firms bought back shares in mass, often using cheap debt to do so, and the stock market boomed. Meanwhile on Main Street, the industrial heart was ripped out of America, these same firms shipped jobs overseas, and communities collapsed.

Figure 2: Stock buybacks track the booming stock market[iv]

Harms of Stock Buybacks

There are two main drawbacks from stock buybacks: 1) increased inequality and 2) decreased innovation.

1. Inequality

Mostly wealthy people own stocks. In the US, only 55% of people own stocks[v], and that portion skews heavily to the high side of the income distribution. As stocks are bought back and the shares appreciate, that further benefits the wealthy. The rich get richer.

Figure 3: US inequality has rapidly increased in the twenty-first century[vi]

2. Innovation

Every dollar that goes toward a stock buyback cannot be spent on research and development (R&D), capital investments, or other purposes that create useful new goods and services. Innovation is difficult to measure, but the number of patents granted is a good approximation. China surpassed the US in patents awarded in 2014 and never looked back.

Figure 4: US and China patent awards since 2000[vii]

An Example: Stock Buybacks and the US Defense Industrial Base

Stock buybacks also impact America’s national security by impairing our defense industrial base. Since the war in Ukraine began in February 2022, the US has pledged more than $115 billion in aid[viii] – an amount that exceeds the annual run rate for the 20-year US war in Afghanistan.[ix] The war has consumed a huge amount of artillery and US munitions factories cannot keep up.[x]

Figure 5: A soldier fires a Javelin anti-tank missile[xi]

The United States has provided a staggering volume of military aid to Ukraine since Russia’s invasion began Feb. 24. The Stingers, Javelins, HIMARS, and 155mm howitzer have upended Russia’s invasion, and Ukraine has successfully regained territory in the east.

Behind this operational success lies an uncomfortable reality: the war in Ukraine has left U.S. defense stockpiles significantly depleted. Current inventories do not undergird a national security strategy that continues to support Ukraine while retaining the ability to assist Taiwan in the event of a Chinese invasion.[xii]

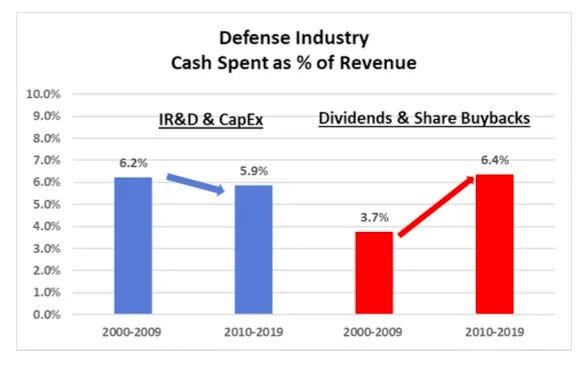

It would be one thing to underestimate the volume of artillery needed in Ukraine, but upon closer inspection the defense contractors providing these munitions have been on a stock buyback spree over the last decade. An astonishing new report from the DoD found that defense contractors reduced the amount of R&D and capital expenditures (investments that yield more munitions) and nearly doubled their stock buybacks.

Figure 6: Defense base stock buyback splurge[xiii]

Warren Buffet Is Wrong

The Omaha-based chairman of Berkshire Hathaway is unquestionably one of the greatest investors in American history. But with all due respect to Mr. Buffet, on the issue of stock buybacks he is wrong.

When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).[xiv]

Figure 7:Warren is wrong[xv]

It would be easier to take Mr. Buffet seriously if his firm, Berkshire Hathaway, did not have one of the largest stock buyback programs in the S&P 500. From 2018-2022, Berkshire Hathaway spent $70 billion on stock buybacks[xvi]. For all the reasons listed in this post, stock buybacks are harmful to firms, the economy, and the country.

Recommended Action

1. Ban stock buybacks

Stock buybacks were made legal in a 1982 rule from the Securities Exchange Commission (SEC). That rule change should be reversed.

These steps fall under 1. Level the playing field in Ad Astra’s 5-point plan to reignite the American Dream.

[i] ChatGPT

[ii] ChatGPT

[iii] https://conversableeconomist.blogspot.com/2013/05/why-did-us-financial-sector-grow.html

[iv] https://www.visualcapitalist.com/stock-buybacks-explained/

[v] https://www.visualcapitalist.com/how-many-americans-own-stocks

[vi] New York Times

[vii] https://www.csis.org/analysis/what-can-patent-data-reveal-about-us-china-technology-competition

[viii] https://usafacts.org/articles/how-much-money-has-the-us-given-ukraine-since-russias-invasion/

[ix] ChatGPT

[xi] https://www.nationaldefensemagazine.org/articles/2022/11/18/the-precarious-state-of-us-defense-stockpiles

[xii] https://www.nationaldefensemagazine.org/articles/2022/11/18/the-precarious-state-of-us-defense-stockpiles

[xiii] https://www.acq.osd.mil/asda/dpc/pcf/docs/finance-study/FINAL%20-%20Defense%20Contract%20Finance%20Study%20Report%204.6.23.pdf

[xiv] https://www.cnbc.com/2023/02/25/warren-buffett-annual-letter-berkshire-hathaway-stock-buybacks.html

[xv] https://www.cnbc.com/2020/08/19/how-warren-buffett-spends-his-billions.html

[xvi] https://stockanalysis.com/stocks/brk.a/financials/cash-flow-statement/