This is the Russia installment in Ad Astra’s American grand strategy for a multipolar world. The series contains 7 white papers: 2 global policies and 5 country-level strategies.

1. Introduction

2. Global trading alliance network

3. China

4. Russia

5. Middle East

6. Mexico

7. India

The world is still dealing with aftershocks from the fall of the Soviet Union in 1991. Conflicts in Eastern Europe, the Balkans, and Central Asia can all be linked to the collapse of the Soviet Union. The world should expect more conflict around the rim of the ghost of the USSR in the 21st century as local powers equilibrate to the vacuum Moscow left behind. The successor to the Soviet Union, the Russian Federation, has risen from the USSR’s ashes fueled by high commodity prices. Since 1991, Russia’s economy has grown 8x and its military budget has grown 8x.

The first lesson to learn from this is Russia’s resource-rich core can take immense hardship without fragmentation, as evidenced by the 1917 Russian Revolution, WW2, the collapse of the USSR, and hundreds of years of pre-20th century Russian history. Likewise, it is likely to produce a strongman leader like Putin or Stalin regardless of national boundaries. To underscore the point, Putin is 71 and the average Russian lifespan is 73[i].Nature is soon likely to produce the same effect as regime change: someone similar.

The second lesson is that Russia derives its power from commodity exports, primarily energy. In the past, Europe has been Russia’s primary export market, but that is shifting east to China. America cannot sever these Russia-China export flows, but it must not force China to be the exclusive market for Russian exports. Doing so would starve Europe and supercharge the Chinse powerhouse. The US strategy towards Russia must be twofold: 1) deprive the Russian government of revenues by exporting America’s own vast natural resources, driving down their prices and 2) empower Europe by removing Russian sanctions but creating a new security architecture for Europe that prevents Russian aggression. Both strategies support America’s own goal of exporting goods to the global middle class as a route to economic prosperity.

Long-term view

Unlike after the Cold War, America must be clear-eyed about Russia’s long-term tendencies. The war in Ukraine will be over and Putin will be gone. Russia is unlikely to become democratic or fragment. Russia will maintain its desire to be a great power and retain an expansionary foreign policy. America must find a way to have relations with Russia, establish a long-term Russia policy and exercise strategic patience. In time, the goal isn’t to defeat Russia but to find a stable equilibrium, prevent war, and enable prosperity all-around. The remainder of this paper will propose such a policy.

Russia’s Bounty

Russia is a massive, resource-rich country that spans 11 time zones. It is a raw material export powerhouse and runs a perennial trade surplus. It vies with the US and Saudi Arabia as the largest crude oil exporter in the world. It is the largest natural gas exporter in the world and a top 3 coal exporter. It is the 3rd largest producer of aluminum and the 2nd largest exporter of nickel. It is the world's largest exporter of the fertilizer ammonium nitrate and has frequently been the world's largest exporter of wheat. Russia is among the world's top five exporters of lumber.

As a result, Russia cannot be unplugged from the global economy without major disruption. 6.5 billion of the world’s 7.9 billion people have not gone along with US-led sanctions in the wake of Russia’s invasion of Ukraine, including China, India, and much of the Global South. As will be shown in the next section, these sanctions have failed.

Sanctions analysis

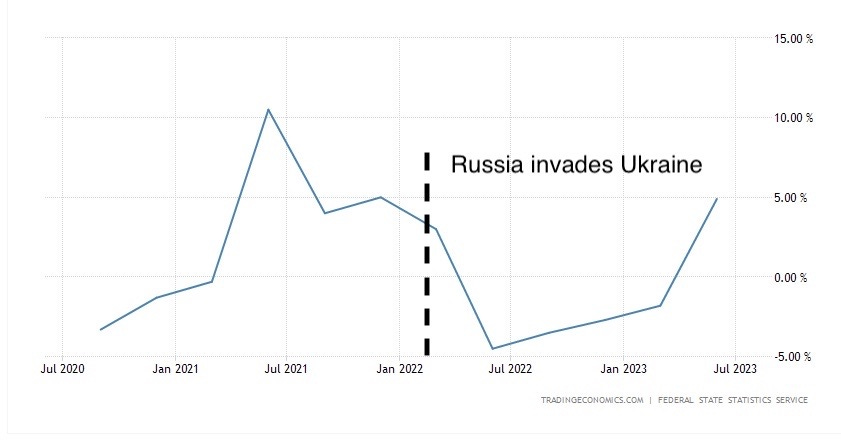

18 months of runtime provides enough data to gauge the effectiveness of sanctions on Russia. After a dip following Russia’s February 24, 2022 invasion of Ukraine, Russia’s annual GDP growth rate has returned to >5% per year:

Figure 1: Russian annual GDP growth rate

In contrast to expected widespread unemployment and bread lines, Russian unemployment has declined from 4% to 3%.

Figure 2: Russian unemployment

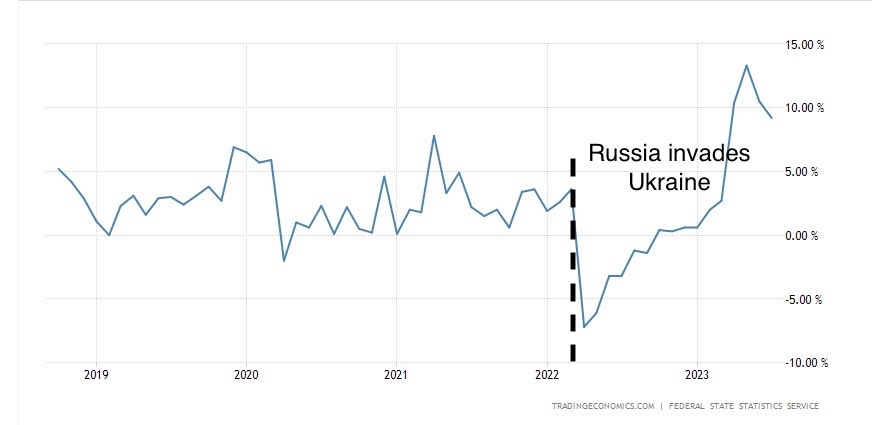

Following a post-invasion dip, Russian wages have increased dramatically.

Figure 3: Russia wage growth (monthly)

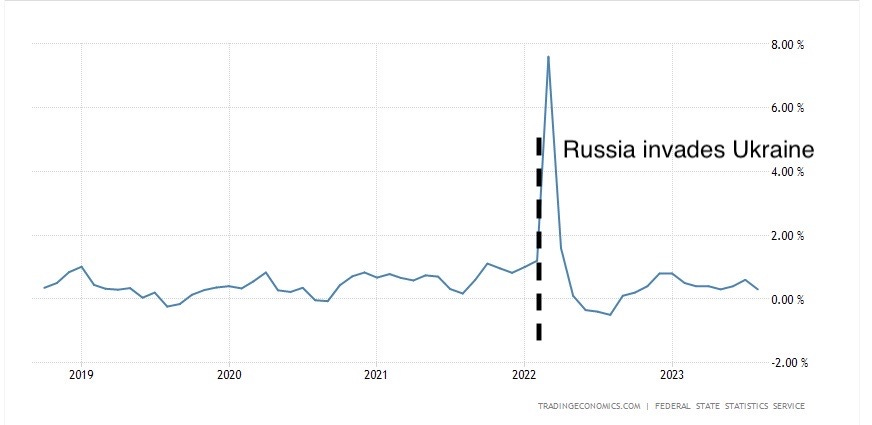

Following a post-invasion spike, Russian inflation has returned to pre-invasion levels.

Figure 4: Russian inflation (monthly)

One of the major theories of sanctions was that widespread hardship would erode Putin’s approval and possibly topple his regime. The data show that economic conditions have not deteriorated for average Russians.

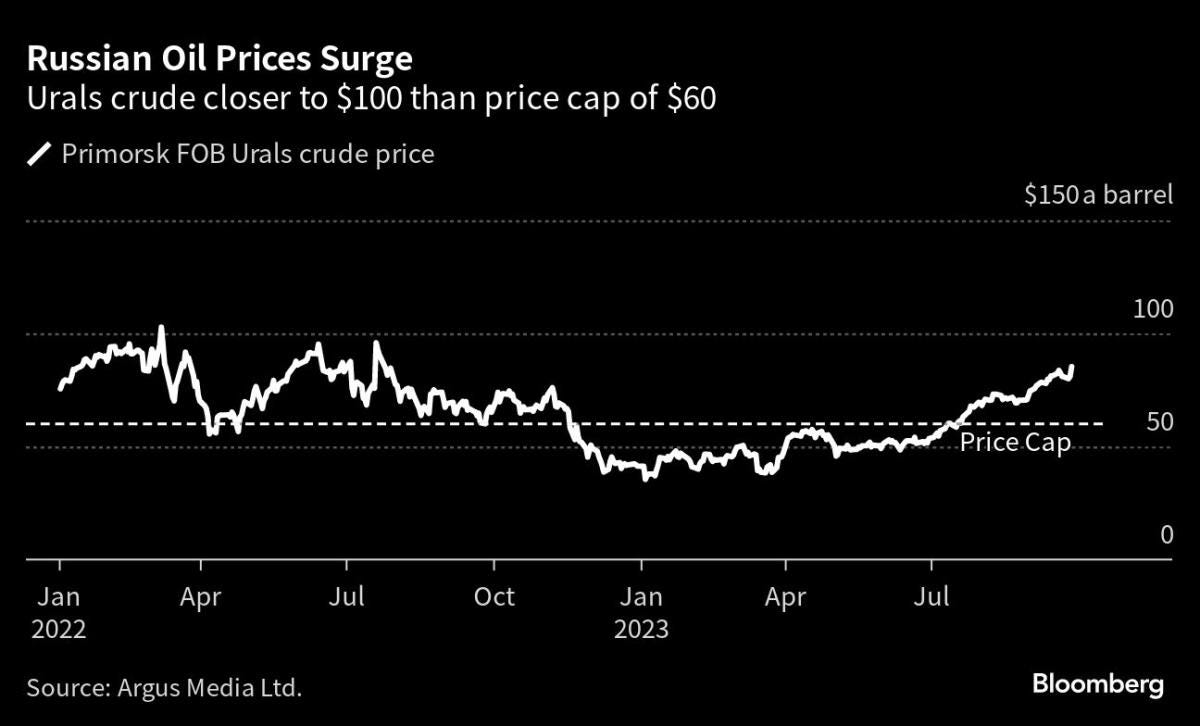

The other main theory of sanctions was that they would deprive the Russian government of revenue to prosecute its war in Ukraine, particularly from energy exports. But despite European export restrictions and a “price cap”, the price for Russian “Urals” crude oil has stayed high.

Figure 5: Urals crude oil price

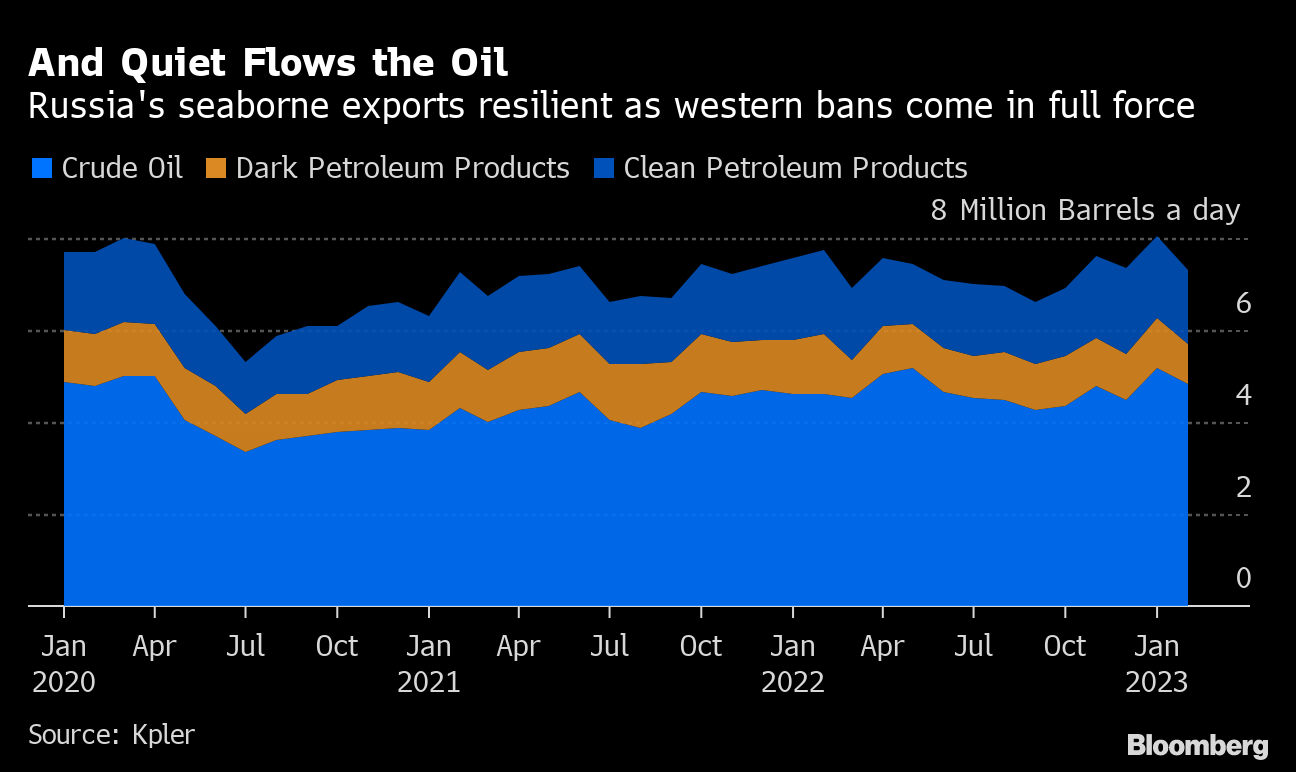

Despite heavy restrictions, Russian seaborne crude oil exports have remained resilient.

Figure 6: Russian seaborne crude oil exports

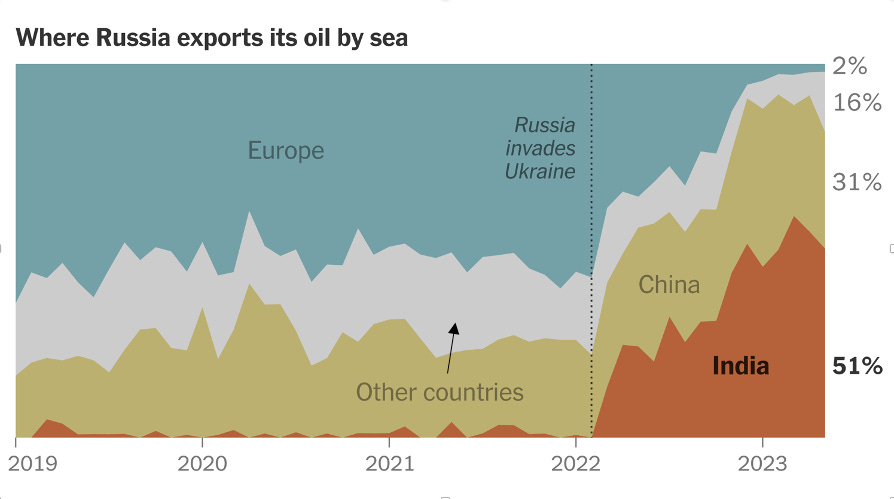

The reason for this resilience is that China and India have picked up the slack from European markets going away.

Figure 7: Destination for seaborne Russian crude oil exports

Based on 18 months of data, Russian economic sanctions have failed to meet their objectives, fueled anti-Western nationalism, and created a stronger Russia-China alliance.

Russia-China alliance

The sanctions have reduced Russian revenues from natural gas which, unlike oil, requires significant investment in the form of a pipeline to market. Most existing pipeline infrastructure connecting Russia to Europe has been reduced, cutoff entirely, or destroyed (in the case of Nordstream). Russian natural gas is stranded in Russia and Rosneft’s revenue (the Russian state energy company, a proxy for the government) has fallen 25% in the first half of 2023 compared to the same period in 2022[ii]. As a result, China is now the largest importer of fossil fuels from Russia, with coal shipments more than doubling since 2020[iii]. Russia is building additional export natural gas pipelines east to China, including the massive Soyuz Vostok, which will provide almost one-third of total Chinese demand when completed in 2025. These Russia-China pipelines are massive investments, take many years to complete, and have been made viable by the war in Ukraine.

Non-energy trade between Russia and China is also surging and Russia’s trade with China jumped 30% in 2022 to a record $191 billion[iv]. In 2023, trade between China and Russia rose by 26% from 2022 to reach a record US$240 billion[v]. Infrastructure projects linking Russia to China have historically been less economic than infrastructure projects to Europe. But with European markets closed off after the war in Ukraine due to Western sanctions, Russia-China links are the only option. Unless European markets reopen, this dynamic will continue, fueling the Russia-China axis.

Figure 8: Russian trade with China[vi]

The currency denomination of trade is also rapidly shifting. The Chinese yuan accounted for almost half of the value of all foreign exchange trading in Moscow in September — up from just 0.4% in January 2022[vii]. Trade denominated in yuan is unreachable by US sanctions.

Figure 9: Denomination of Russian trade switches to yuan[viii]

Military cooperation between Russia and China is also increasing. In July 2023, nearly a dozen Chinese and Russian warships conducted 20 combat exercises in the Sea of Japan before beginning a 2,300-nautical-mile joint patrol, including into the waters near Alaska.[ix] China is building next-generation nuclear submarines based on shared Russian technology[x]. The West should be taking advantage of the shared historical animosity between Russia and China rather than forcing them closer together.

Sanctions impact on Europe

European industry was built on the back of cheap Russian natural gas, so the removal of that gas and its replacement with higher cost LNG has led to widespread deindustrialization. Nowhere has been hit harder than Germany, whose export-led manufacturing economy has been gutted.

Figure 10: German industrial production

Sanctions on Russia has led to widespread inflation, high energy prices, and deindustrialization leading to a wave of anti-establishment political parties taking power across Europe. Many of these parties include in their planform a cessation of military aid to Ukraine and restored ties with Russia.

If the Russian sanctions stay in place, four things will happen. First, Europe will begin to resent the US, blaming their economic troubles on US foreign policy. Second, new governments will be elected and restore trade with Russia, gradually eroding any residual bite from the sanctions. Discord between European nations will threaten the EU itself. Third, Russia will be forced into close economic and military partnership with China. Finally, Russia and China will win over 6+ billion people in the Global South by saying the sanctions are raising their food and energy prices.

Trans-Atlantic policy

The goal of US policy should be to establish Europe as an independent pole in a new global multipolar order. A strategically autonomous Europe would increase its defense spending, a burden overwhelming carried by the US today. An independent Europe could counter Russia, establishing a new, stable balance. The US should negotiate a new European security architecture with Russia and Europe, underpinned by arms control agreements and defense treaties.

Russian detente

Simultaneously, Western diplomatic ties and trade must be restored with Russia. The war in Ukraine must be ended, in exchange for lifting sanctions. To the argument that funding the Ukraine war is money well spent, there are three responses. First, the war is causing inflation and commodity market disruption, eroding support in the West, particularly in Europe. Second, the war and sanctions are pushing Russia and China (and North Korea and Iran) together. Third, Russia and China are using the war and sanctions in a propaganda effort to consolidate the support of the Global South. In short, perpetuating the war is a tactical victory but a strategic loss in 21st-century great power competition.

The US cannot abandon Ukraine and must maintain a robust defensive relationship with the region. History warns us of the danger of fully disengaging from the world. The US withdrew from Europe after WW1, precipitating WW2. US President GW Bush “looked into Putin’s soul” in 2001 and drew down forces in Europe, only for Putin’s Russia to invade Georgia in 2008. US President Obama tried to “reset” relations with Russia, only for Russia to annex Crimea in 2014. Further war in Europe would distract the US from focusing on China. Therefore, the US must leave the situation in Europe stable and able to be handled by Europe.

The West must pledge Ukraine will not join NATO, the impetus for this war. Using the Korean model for territorial settlement will include a DMZ buffer between Russia and the West, whose ties will no doubt remain tense. The West should give the new Ukrainian state defense guarantees, including arms sales, to deter any future Russian advance. This will give NATO a heavily armed, experienced ally on its eastern flank.

Russia will lose its leverage over Europe through its natural gas pipelines, as Europe will retain the option to import LNG. But both countries will benefit from resumed energy trade. As in the Cold War, NASA and Roscosmos (the Russian space agency) should cooperate to build ties between the two nations. Western energy companies should form joint ventures with Russian firms on projects in Siberia and Central Asia to prevent those resources from becoming captive to China. There should also be people to people exchanges and other investment opportunities between Russia and the West.

In the long-term, the US must flip Russia against China, but this is unlikely to occur in the near-term. The US should opportunistically seek to drive a wedge between Russia and China.

US-Eastern Europe policy

Détente with Russia will not make them a trustworthy, cooperative state who shares US interests. Russia will remain a dangerous rival with different national interests than the US. Therefore, the US must arm the eastern border countries of NATO, particularly but not limited to Poland and non-NATO Ukraine. The new DMZ between Ukraine and Russia will become the frontline between East and West and needs to be heavily fortified and garrisoned by veteran Ukrainian troops. Poland has seen firsthand Russian aggression and possesses the public support for military buildup. They have already significantly increased military spending and the US should ensure the Poles have access to state-of-the-art weapons, training, and intelligence.

The US and its allies should also support Eastern Europe economically, creating a belt of prosperity to blunt Russian expansion. America should lead the rebuilding of Ukraine through a combination of government aid and directed foreign private investment. The US private sector should be incentivized to invest all over Eastern Europe.

The oil weapon

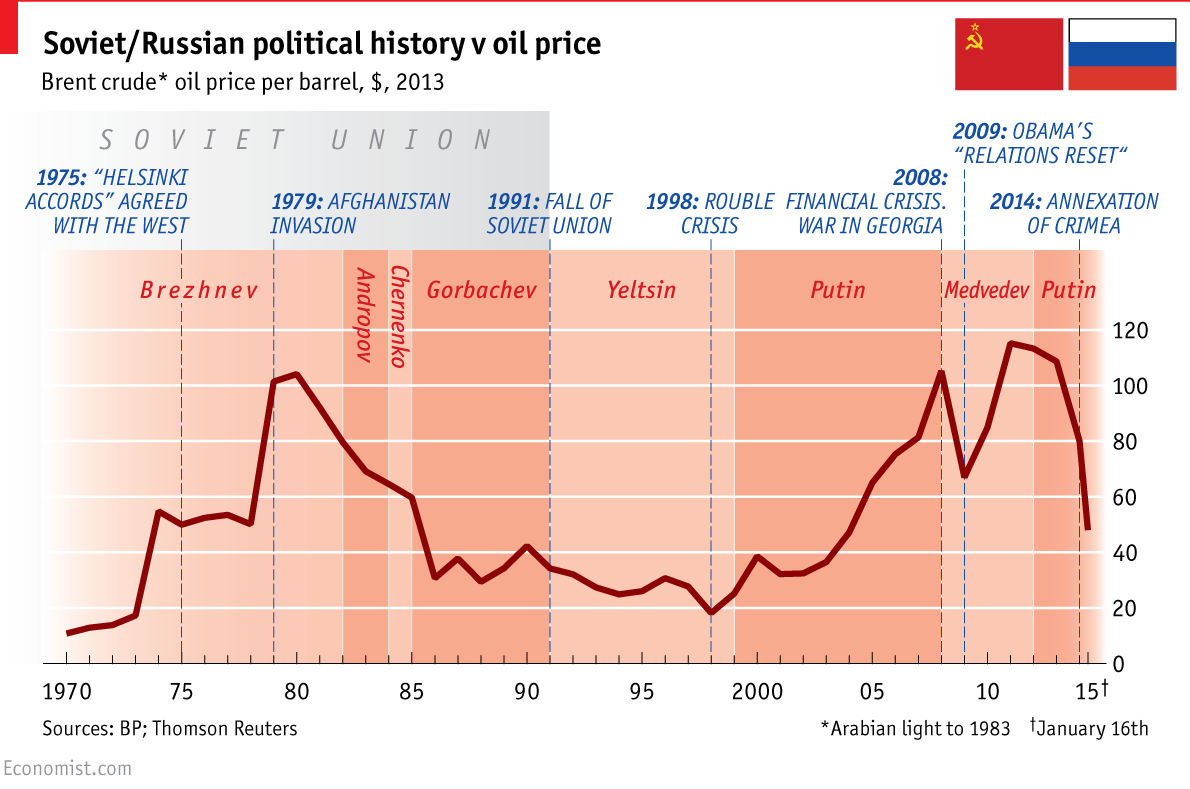

The strategy that began in the 1940s, latest throughout, and ultimately won the Cold War for the US was “containment”. But with hindsight, scholars generally agree that low oil prices in the 1980s and the resulting low revenue for the Soviet government led to the collapse of the USSR. Putin has enjoyed high oil prices in the 21st century and has used them to rebuild Russia.

Figure 11: The oil price's impact on Russian politics

America’s best strategy to combat Russia is to encourage oil production and thereby lower the oil price. This does not preclude the rollout of renewable energy sources as any oil demand destruction will lower the oil price. Lowering the oil price also supports domestic manufacturing and dovetails with the overall US goal to export goods to the global middle class.

The lessons of history remind us of the resilience of Russia's resource-rich economy and its innate ability to weather storms. The unintended creation of a robust Russia-China alliance in the face of Western sanctions and the subsequent economic strain on Europe underscores the necessity of reevaluating our approach. For the sake of global stability and mutual prosperity, the United States must lead the charge in crafting a balanced strategy that embraces détente while protecting its own interests. This entails opening diplomatic channels, facilitating trade, and ensuring that Europe remains economically robust. The oil market remains a pivotal point of leverage against Russia and the strategic use of oil as an economic tool is critical.

1. Introduction

2. Global trading alliance network

3. China

4. Russia

5. Middle East

6. Mexico

7. India

[i] https://www.macrotrends.net/countries/RUS/russia/life-expectancy

[ii] https://www.rosneft.com/press/releases/item/215549/

[iii] https://www.bloomberg.com/news/features/2023-10-16/china-russia-relations-will-xi-jinping-s-gamble-on-vladimir-putin-pay-off

[iv] https://www.themoscowtimes.com/2023/07/20/russia-slaps-domestic-travel-curbs-on-uk-diplomats-a81913

[v] https://www.scmp.com/economy/global-economy/article/3249104/will-china-russia-trade-keep-skyrocketing-ukraine-war-drags-2024

[vi] https://www.themoscowtimes.com/2023/07/20/russia-slaps-domestic-travel-curbs-on-uk-diplomats-a81913

[vii] https://www.bloomberg.com/news/features/2023-10-16/china-russia-relations-will-xi-jinping-s-gamble-on-vladimir-putin-pay-off

[viii] https://www.bloomberg.com/news/features/2023-10-16/china-russia-relations-will-xi-jinping-s-gamble-on-vladimir-putin-pay-off

[ix] https://foreignpolicy.com/2023/09/11/china-russia-alliance-cooperation-brics-sco-economy-military-war-ukraine-putin-xi/

[x] https://www.reuters.com/world/asia-pacific/inside-asias-arms-race-china-near-breakthroughs-with-nuclear-armed-submarines-2023-10-09/