Why the economy isn’t good (despite reports to the contrary)

Fast food and hair salons don’t make a strong American economy

Key takeaways

1. Low unemployment and strong GDP growth are a mirage: Despite glowing reports of low unemployment and strong GDP growth, the reality for many Americans is starkly different. The economic indicators fail to capture the essence of economic well-being for the average citizen. A service-heavy economy, with an over-reliance on sectors like fast food and personal care, does not provide the same stability or prosperity as the manufacturing jobs of the past. This disconnect between official reports and consumer sentiment reveals a deeper malaise, pointing to the need for a reassessment of what true economic health looks like.

2. America needs an industrial renaissance: The issue lies in the decline of America's manufacturing base, once the backbone of the economy and a source of good, middle-class jobs. The stark comparison of the US's industrial sector with those of other nations underscores the urgency for a reinvigorated focus on manufacturing. Ad Astra offers a blueprint for reversing this industrial decline, highlighting the importance of shifting from a consumption-driven economy to one that balances production and consumption. Such a shift not only promises to address current economic disparities but also to lay the foundation for a more robust and equitable economy.

US Industrial Policy Series

1. Overview

2. Metals

3. Defense Base

6. Execution

Most major news outlets and government reports say that the economy is good. Unemployment is at multi-decade lows and GDP growth, a measure of the rate of economic growth, is strong. Yet consumer sentiment surveys continue to show that regular people think the economy is bad. In fact, the data are similar to what was measured during the Great Recession in 2008-2010[i].

Others have diagnosed the survey-data disconnect as the result of inflation. Although the rate of price growth has come down, the absolute level of prices has not. A hamburger costs 28% more in 2024 than in 2019, and people don’t like that.

The economist Larry Summers has argued that all of the survey-data disconnect can be explained by higher interest rates, which aren’t included in government reports on inflation.

That may all be true but it misses the mark. American’s industrial base has been hallowed out and all the good, middle-class jobs that accompanied it are gone.

This post will examine how much the US has deindustrialized, the impact on wealth inequality, and how we can bring industry back to America.

Structure of US economy

Any economy is made up of 4 parts: consumption, investment, government spending, and net imports. Consumption is what you and I spend our money on: fast food, haircuts, Netflix subscriptions, etc. Consumption spending is predominantly on services. Investment is when a business buys a new piece of machinery or something similar. Government spending is anything that the government spends money on, including the military. Net imports are imports minus exports. Anything we buy from China is an import. When Boeing sells a plane to a foreign country, that’s an export. If a country imports more than it exports, the net imports term is negative and is a drag on the GDP calculation. In America, net imports are very negative. America has a very large consumption economy, the largest in the world. That can be a good thing unless the economy becomes so unbalanced that it is overly reliant on consumption, which has happened in America.

In the 1950s, manufacturing made up almost a third of US GDP. That figure has fallen to just 11% today[ii].

Conversely, consumption makes up a whopping 68% of US GDP today[iii].

Recent events have shown that a nation cannot get by flipping one another’s hamburgers, it must make things. America stumbled when making PPE during the pandemic, we can’t supply Ukraine with enough ammunition because we don’t have the manufacturing capacity, and we lag behind our great power competitors China and Russia in manufacturing military hardware, like hypersonic missiles.

Meanwhile, other nations have large manufacturing sectors. 38% of China’ GDP is industrial[iv], as is 26%[v] of South Korea’s economy, 19%[vi] of Japan’s economy, and 18%[vii] of Germany’s economy.

Inequality

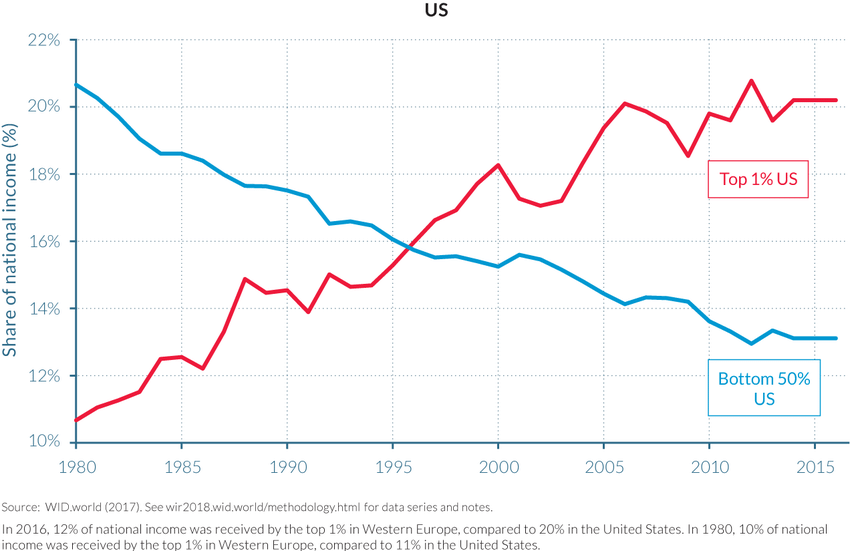

The disappearance of American industry has led to the evaporation of millions of good jobs. Even if those displaced workers have found other jobs, they do not pay well. Over the past several decades, the share of income going the top 1% has surged and today is almost 2x the amount going to the entire bottom 50%.

It’s no wonder that the top 33% of earners view the economy very differently than the bottom 33%. There is a 36pt difference between how the bottom and top perceive their Current Financial Situation Compared with a Year Ago[viii].

The fast-food economy

The American economy in 2024 excels at service industries like fast food and is bad at making things. Luckily Ad Astra has a plan to restart the heart of American industry. Over the past month, Ad Astra has released 6 papers on US industrial policy:

US Industrial Policy Series

1. Overview

2. Metals

3. Defense Base

6. Execution

Following this blueprint can reverse American industrial decline and provide many good, middle-class jobs. The economy’s seeming health, evidenced by low unemployment and strong GDP growth, masks deeper issues rooted in the nature of American economic activity and its consequences for the population. The reliance on a service-oriented economy, typified by sectors like fast food and personal care, does not offer the stability or prosperity that manufacturing once did. This shift from a manufacturing-based to a service-based economy has led to significant income inequality, with the loss of middle-class jobs and the concentration of wealth in the hands of the few. While major economic indicators may suggest prosperity, they fail to capture the everyday realities of Americans, whose living standards are pressured by rising prices, higher interest rates, and a job market that increasingly offers low-paying, insecure service roles rather than secure, well-paying manufacturing jobs. The challenge ahead is not just to generate economic growth, but to ensure that this growth is inclusive and sustainable, restoring the balance between consumption and production in a way that benefits all Americans.

[i] http://www.sca.isr.umich.edu/files/chicsh.pdf

[ii] https://data.worldbank.org/indicator/NV.IND.MANF.ZS?locations=US

[iii] https://ycharts.com/indicators/personal_consumption_gdp

[iv] https://www.statista.com/statistics/270325/distribution-of-gross-domestic-product-gdp-across-economic-sectors-in-china/

[v] https://data.worldbank.org/indicator/NV.IND.MANF.ZS

[vi] https://data.worldbank.org/indicator/NV.IND.MANF.ZS